AUD/USD Rally Fails to Push RSI Into Overbought Zone

AUSTRALIAN DOLLAR TALKING POINTS

AUD/USD Rally: AUD/USD snaps the recent series of higher highs and lows after trading to a fresh yearly high (0.7540) at the start of the week, and the exchange rate appears to be reversing ahead of the October high (0.7556) as the recent rally fails to push the Relative Strength Index (RSI) into overbought territory.

AUD/USD RALLY FAILS TO PUSH RSI INTO OVERBOUGHT ZONE

AUD/USD bounces back from the session low (0.7456) as hopes for a Russia-Ukraine peace deal drags on the Greenback, and a further improvement in risk appetite may keep the exchange rate afloat as it shows a limited reaction to the larger-than-expected rise in Australia Retail Sales.

It remains to be seen if the 1.8% rise in household spending will influence the Reserve Bank of Australia (RBA) as the central bank acknowledges that “while inflation has picked up, it is too early to conclude that it is sustainably within the target range,” and it seems as though Governor Philip Lowe and Co. will stick to a wait-and-see approach for the foreseeable future as “the Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range.”

As a result, the diverging paths for monetary policy may have longer-term implications for AUD/USD as Chairman Jerome Powell and Co. look to implement a series of rate hikes over the coming months, and swings in investor confidence may sway the exchange rate ahead of the next RBA meeting on April 5 as the recovery in global equity prices persists.

Until then, the commodity bloc currencies may continue to outperform their major counterparts as the Federal Open Market Committee (FOMC) plans to“begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting,” but a further rise in AUD/USD may fuel the recent flip in retail sentiment like the behavior seen during the previous year.

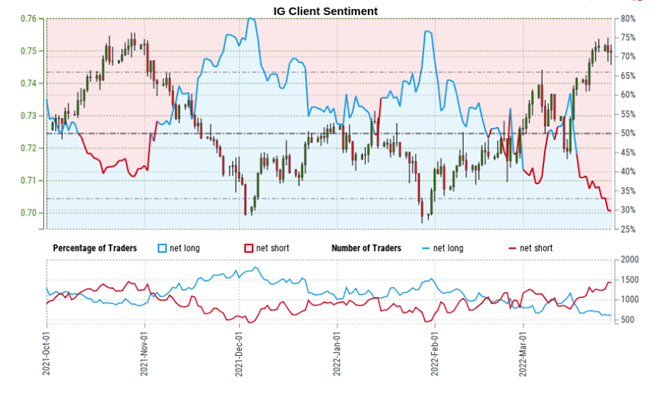

The IG Client Sentiment report shows 30.76% of traders are currently net-long AUD/USD, with the ratio of traders short to long standing at 2.25 to 1.

The number of traders net-long is 1.29% lower than yesterday and 16.82% lower from last week, while the number of traders net-short is 3.29% higher than yesterday and 11.47% higher from last week. The decline in net-long position comes as AUD/USD snaps the recent series of higher highs and lows from last week, while the rise in net-short interest has fueled the tilt in retail sentiment as 36.46.% of traders were net-long the pair last week.

With that said, AUD/USD may stage further attempts to test the October high (0.7556) amid the recovery in risk appetite, but the bullish momentum appears to be abating as the recent rally in the exchange rate fails to push the Relative Strength Index (RSI) into overbought territory.

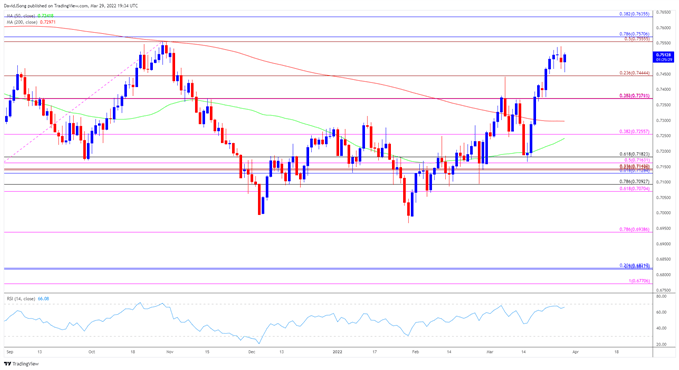

AUD/USD RATE DAILY CHART

- AUD/USD trades above the 200-Day SMA (0.7297) for the first time since June 2021 as it clears the yearly opening range in March, with the break/close above the 0.7440 (23.6% expansion) region pushing the exchange rate towards the 0.7560 (50% expansion) to 0.7570 (78.6% retracement) area, which lines up with the October high (0.7556).

- However, developments surrounding the Relative Strength Index (RSI) indicate that the bullish momentum is abating

as it appears to be reversing ahead of overbought territory, and failure to push above 70 may accompany a near-term correction in AUD/USD as it snaps the series of higher highs and lows from the previous week. - In turn, lack of momentum to hold above the 0.7440 (23.6% expansion) region may push AUD/USD back towards 0.7370 (38.2% expansion), with a move below the 200-Day SMA (0.7297) bringing the 0.7260 (38.2% expansion) area back on the radar.