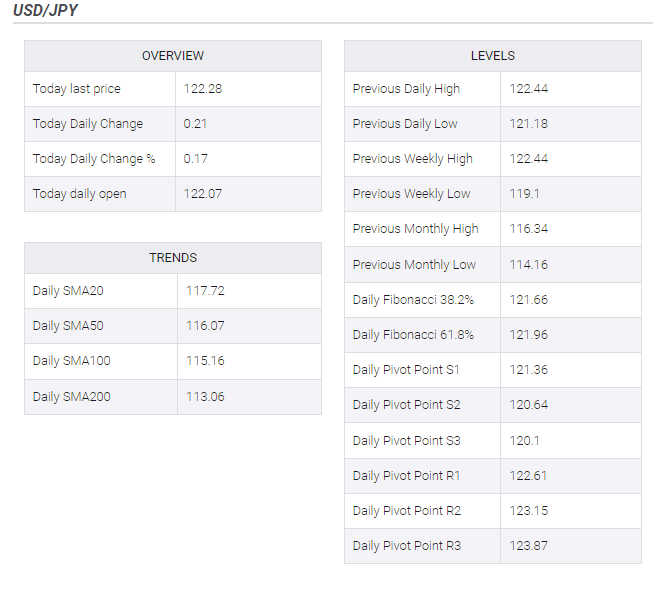

USD/JPY Price Analysis: Advances towards 124.00 as the RSI (14) hit fresh highs at 79.50

- An open test-drive session is likely to keep the greenback bulls on a positive trajectory.

- The RSI (14) has printed a fresh high at 79.45, points more gains ahead.

- Bulls are firmer above 10 and 20-period EMAs.

USD/JPY Price Analysis: The USD/JPY pair has remained one of the top performers for the investors and

has been rallying after surpassing the psychological level of 120.00 in the past few trading sessions. The

asset is indicating a bullish open test-drive session on Monday. The pair has been opened on a flat note

at 122.07, witnesses a minor weakness towards the psychological support of 122.00 but bounced back

sharply and oversteps the Monday’s open decisively.

On the weekly scale, USD/JPY has witnessed a juggernaut rally after a breakout out of the rising channel

on the upside. The upper end of the rising channel is placed from 2 April 2021 high at 110.97 while the

lower end is marked from 8 January 2021 low at 102.59. Moreover, the asset has also surpassed its five-

year-old resistance at 118.66.

The 10 and 20-period Exponential Moving Averages (EMAs) are scaling higher at 116.70 and 115.25

respectively, which adds to the upside filters.

USD/JPY Price Analysis:

The Relative Strength Index (RSI) (14) has printed a fresh high at 79.45, points more gains ahead.

Should the major test its ground of five-year-old resistance at 118.66, a build-up of fresh bids will

drive the pair towards the psychological resistance of 120.00, followed by a 5 February 2016 high at

121.49.

On the flip side, bears can take control if the pair slips below March 15 low at 117.70. This will drag the

pair towards 10 and 20-period EMAs at 116.70 and 115.25 respectively.

USD/JPY Price

Trading the forex market allows for the use of various other order types which can benefit the trader. Spend time getting to grips with these to feel more confident managing your trades.

Traders often look to retail client sentiment when trading popular FX markets. provides such data, based on IG client sentiment.

wavesscoutforex hosts multiple webinars throughout the day, covering a number of topics related to the forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our wavesscoutforex