NZD/USD May Fall as APAC Traders Brace for US Jobs Report

NEW ZEALAND DOLLAR, NZD/USD, EQUITIES, CONSUMER CONFIDENCE, JOBS REPORT – TALKING POINTS

- Asia-Pacific traders may take a defensive stance after US stocks fall ahead of jobs report

- New Zealand sees its worst consumer confidence report on record, but Kiwi Dollar unfazed

- NZD/USD may see more downside after MACD crossover, overhead psychological resistance

FRIDAY’S ASIA-PACIFIC OUTLOOK

NZD/USD May Fall as: Asia-Pacific traders will kick off second-quarter trading today following a poor performance on Wall Street, where the S&P 500 index shed 1.57%. The US reported its highest inflation print since 1983 via the Fed-preferred Personal Consumption Expenditures Index (PCE). That firmed up already high Fed rate hike bets, pressuring the US Dollar higher as short-term Treasury yields rose. The yield curve flattened along with the closely watched 10-year/2-year spread. The risk-sensitive New Zealand Dollar fell against the Greenback.

Asian equity trading may see technology stocks get hit especially hard today after the US-listed Nasdaq Golden Dragon China Index fell over 5% in New York. The tech-heavy CSI-300 Index fell 0.74% yesterday. Meanwhile, Brent crude oil prices dropped nearly 5% over the last 24 hours. That weakness may continue as traders mull President Biden’s plan to release 1 million barrels per day from the Strategic Petroleum Reserve (SPR).

NZD/USD May Fall as

Consumer confidence in New Zealand dropped to 77.9 in March, according to a survey by ANZ Bank/Roy Morgan. That was down from 81.7 in February and marks the worst figure on record since the survey began in 2004. The dreary data stems from rising prices and practically zero confidence that it’s the right time to buy a house. Despite that, the New Zealand Dollar traded slightly higher versus the USD.

This morning also saw Australia’s manufacturing index increase from the prior month. AUD/USD is outpacing NZD/USD higher. Japan will see Tankan manufacturing and non-manufacturing data for Q1 cross the wires. Australian home loans data (Feb) will wrap up the week for the APAC region. Tonight, traders will be watching the high-profile US jobs report. A strong report may actually hamper the Greenback amid growing stagflation fears.

NZD/USD TECHNICAL FORECAST

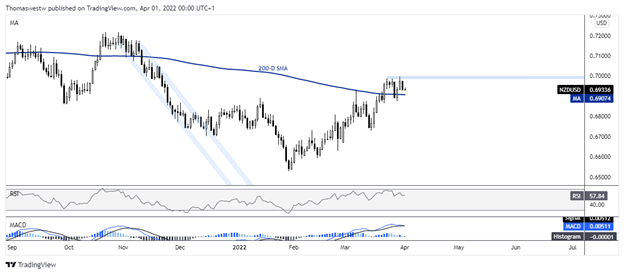

NZD/USD fell overnight after retreating from its highest level (0.6998) since November 2021 earlier this week. The 200-day Simple Moving Average (SMA) may provide support if prices continue to fall. The MACD oscillator crossed below the signal line this morning, which may help foster some bearish energy. However, if bulls push prices higher, the psychological 0.7000 level may keep the 2022 high defended.

NZD/USD DAILY CHART