Monthly Forex Seasonality – March 2022: More USD Strength, Weakness for AUD, CAD, NZD

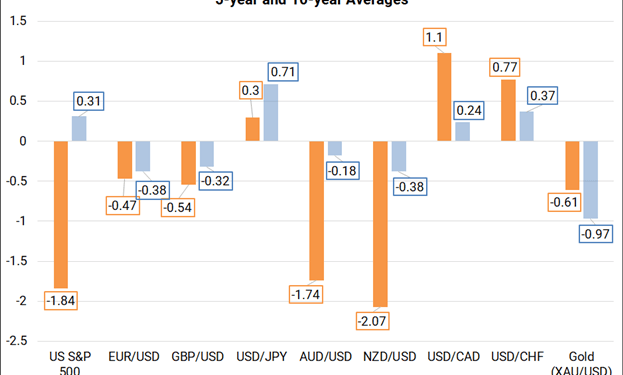

Monthly Forex Seasonality, March typically brings a risk-off tone, with the US Dollar faring better than all of the other major currencies. The commodity currencies – the Australian, Canadian, and New Zealand Dollars – tend to have the worst performance. Like last month, US stocks tend to have a mixed performance, with a divergence between the 5- and 10-year averages..

RECOMMENDED BY CHRISTOPHER VECCHIO, CFAGet Your Free Top Trading Opportunities ForecastGet My Guide

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. For February, our focus is on the trailing 5-year and 10-year performances, both of which fully capture trading during the era of quantitative easing and expanding government deficits since the 2008/2009 Global Financial Crisis – not dissimilar from the environment we find ourselves in during the coronavirus pandemic recovery.

There is a big caveat with this month’s seasonality review, however: the Russian invasion of Ukraine has provoked a significant wave of volatility, pushing prices higher and lower violently across asset classes. If there has been a month in recent memory whereby seasonality tendencies may want to be downgraded in terms of their reliability or actionability, this March would be that month.

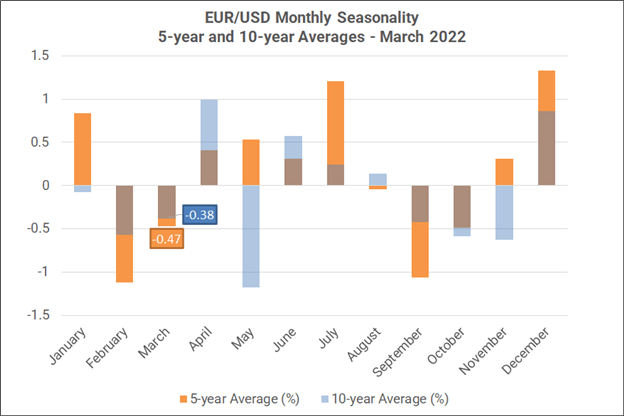

FOREX SEASONALITY IN EURO (VIA EUR/USD)

March is a bearish month for EUR/USD, from a seasonality perspective. Over the past 5-years, it has been the fourth worst month of the year for the pair, averaging a loss of -0.47%. Over the past 10-years, it has been the sixth worst month of the year, averaging a loss of -0.38%.

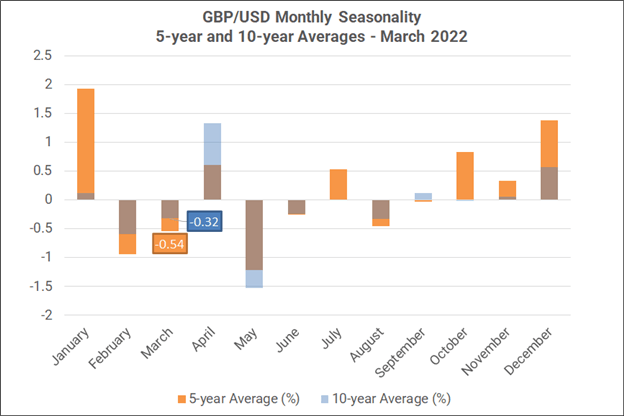

FOREX SEASONALITY IN BRITISH POUND (VIA GBP/USD)

March is a bearish month for GBP/USD, from a seasonality perspective. Over the past 5-years, it has been the third worst month of the year for the pair, averaging a loss of -0.54%. Over the past 10-years, it has been the fourth worst month of the year, averaging a loss of -0.32%.

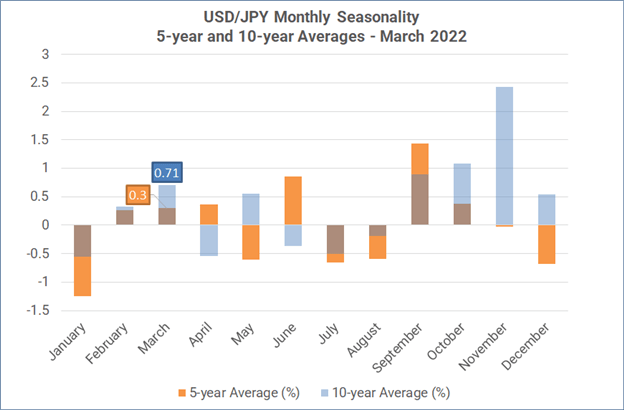

FOREX SEASONALITY IN JAPANESE YEN (VIA USD/JPY)

March is a bullish month for USD/JPY, from a seasonality perspective. Over the past 5-years, it has been the fifth best month of the year for the pair, averaging a gain of +0.30%. Over the past 10-years, it has been the fourth best month of the year, averaging a gain of +0.71%.

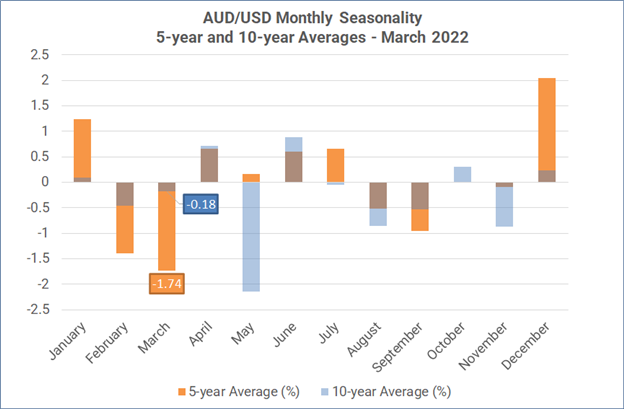

FOREX SEASONALITY IN AUSTRALIAN DOLLAR (VIA AUD/USD)

March is a very bearish month for AUD/USD, from a seasonality perspective. Over the past 5-years, it has been the worst month of the year for the pair, averaging a loss of -1.74%. Over the past 10-years, it has been the sixth worst month of the year, averaging a loss of -0.18%.RECOMMENDED BY CHRISTOPHER VECCHIO, CFAHow to Trade AUD/USDGet My Guide

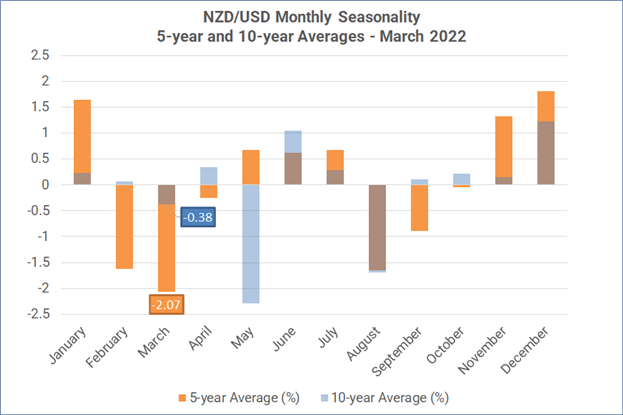

Monthly Forex Seasonality, FOREX SEASONALITY IN NEW ZEALAND DOLLAR (VIA NZD/USD)

March is a bearish month for NZD/USD, from a seasonality perspective. Over the past 5-years, it has been the worst month of the year for the pair, averaging a loss of -2.07%. Over the past 10-years, it has been the third worst month of the year, averaging a loss of -0.38%.

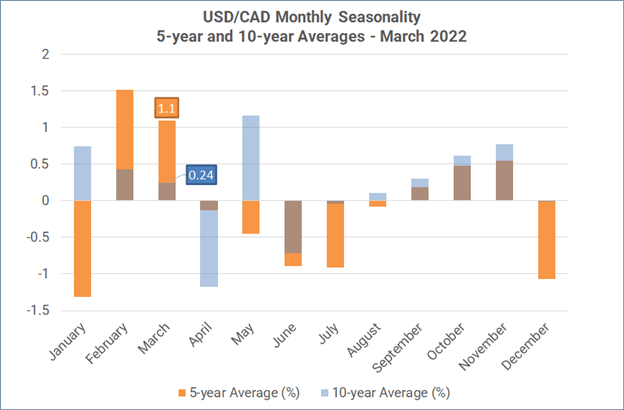

FOREX SEASONALITY IN CANADIAN DOLLAR (VIA USD/CAD)

March is a very bullish month for USD/CAD, from a seasonality perspective. Over the past 5-years, it has been the second best month of the year for the pair, averaging a gain of +1.10%. Over the past 10-years, it has been the sixth best month of the year, averaging a gain of +0.24%.

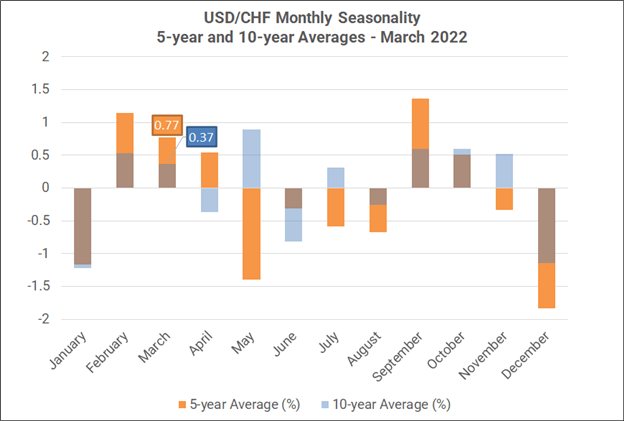

FOREX SEASONALITY IN SWISS FRANC (VIA USD/CHF)

March is a bullish month for USD/CHF, from a seasonality perspective. Over the past 5-years, it has been the third best month of the year for the pair; averaging a gain of +0.77%. Over the past 10-years, it has been the sixth best month of the year, averaging a gain of +0.37%.

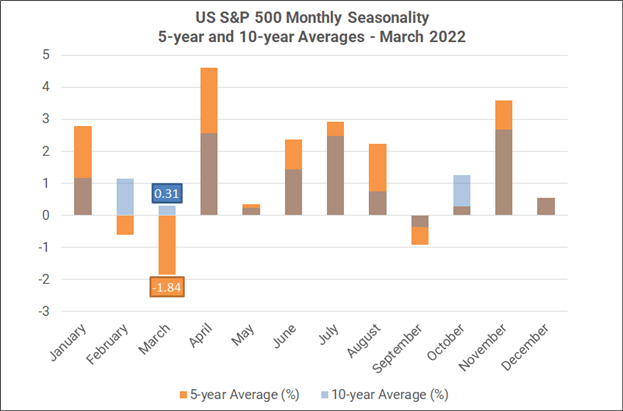

FOREX SEASONALITY IN US S&P 500

March is a mixed month for the US S&P 500, from a seasonality perspective. Over the past 5-years; it has been the worst month of the year for the index, averaging a loss of -1.84%. Over the past 10-years, it has been the third worst month of the year; averaging a gain of +0.31%.

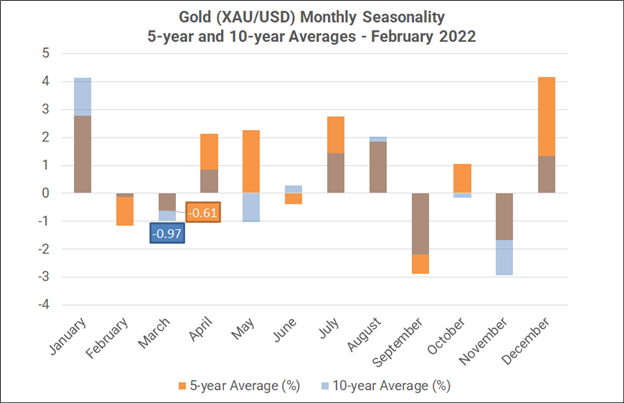

FOREX SEASONALITY IN GOLD (VIA XAU/USD)

Monthly Forex Seasonality, March is a bearish month for gold (XAU/USD), from a seasonality perspective. Over the past 5-years, it has been the fourth worst month of the year for the precious metal; averaging a loss of -0.61%. Over the past 10-years; it has been the fourth worst of the year; averaging a loss of -0.97%.