Fantastic Australian Manufacturing data. War risks expansion.

Clifford Bennett – Chief Economist | World’s most accurate currency forecaster

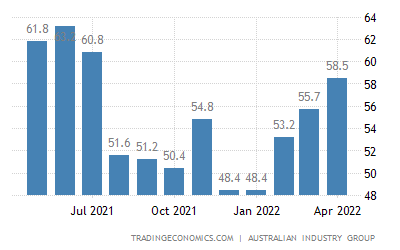

AIG Manufacturing Index for Australia rose to a very impressive 58.1 in April. Hats off and congratulations to the private sector.

Australian Manufacturing: Will it last. The odds would favour there is still a lot of catch up to be seen. And most importantly, global supply chain disruption is favouring buying local goods again.

In terms of overseas demand though, we have just seen the PMI data for China this morning go ever deeper into serious contraction territory. No surprise there. Lock downs have a particular style of data crash to them.

The world’s biggest port remains closed. When it does reopen, there is likely to be a challenging period of catch up with significant further micro-dislocation around the port itself, For perhaps a further 3 months. Global supply chains are no light bulb affair. No simple switch on switch off economic trajectory.

My forecast of a recession in China remains on track. Though, I do see it as a touch and go recession. With China coming out of the current entrenched northern hemisphere slow-down ahead of the USA. Perhaps years ahead of the new slowing and recession in Europe.

While all this negative economic reality should be concerning for the Australian economy, leaders and business, the manufacturing sector could, like employment, be a stand-out beneficiary of reduced global interaction. Travel and goods.

The stock market crash picture we painted at the start of the year continues to take its ugly and potentially terrifying form. While only just returning yet again to recent lows in the USA, the market there looks to be bit of a cliff hanger. As in, may not be able to hold on.

Australian Manufacturing

This predicament is steady weighing more heavily on local sentiment.

The Australian stock market, now that higher commodity prices are fully priced in, is highly vulnerable to renewed global sentiment concern on inflation, higher rates, war, growing recessionary pressures Europe, USA and China.

With the weaponisation of energy now on our global doorstep the hazardous trend toward a more profound USA military supply and Russian forces conflict is growing rapidly.

We highlighted war could well happen when few believed it was possible.

As the US ramps up significantly further military supplies to Ukraine, direct Russian attacks upon the pipelines of that military equipment, ever closer to other borders of neighbouring nations, is not something markets should take lightly.

Remain bullish the US dollar, Gold and Oil. Remain bearish equities. Yes, market war trend resumption and entrenchment is still the most likely risk scenario.