Top 5 Benefits of Using Entry Orders in Forex Trading

Orders in Forex Trading: Entry orders are a valuable tool in forex trading. Traders can strategize to come up with a great trading plan, but if they can’t execute that plan effectively, all their hard work might as well be thrown out the window. The forex market is open 24 hours a day, so this means no trader can keep an eye on it all the time. So, traders need a way to execute our trading plan that fits with their daily schedule.

This is where setting up forex entry orders comes into play. Entry orders allow traders to set the price that they would like to buy or sell a currency ahead of time. This will only be executed if that specific price is hit. There are several benefits to trading forex using entry orders, which we explore below.

WHAT IS AN ENTRY ORDER IN FOREX TRADING?

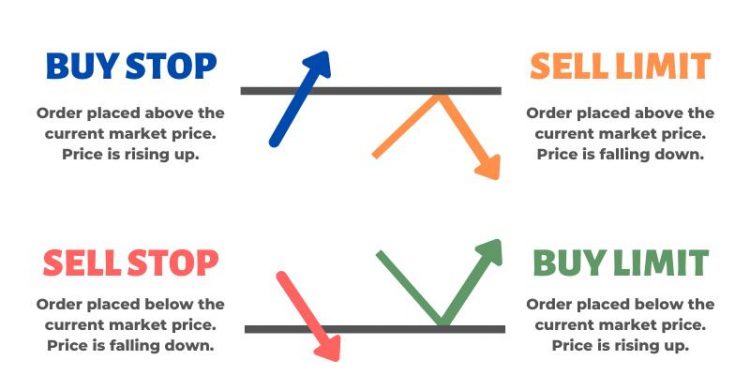

A forex entry order is an order that is placed at a specified price level for a currency pair. Once this price is reached, the order is then executed/filled. If the price never reaches the desired price level, the order will not execute. The type of order can vary as well, which should be taken into consideration prior to placing the forex order.

TOP 5 BENEFITS OF USING FOREX ENTRY ORDERS

1. Price Control

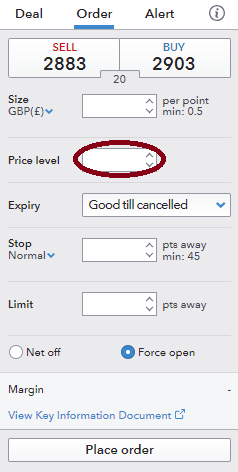

Orders in Forex Trading: The first benefit of entry orders is the control they provide over price level. Traders can indicate their desired price level entry point at which the trade will execute. Having this ability to designate a level allows for ease of trading without having to constantly monitor the market.

The image below shows an example of a deal ticket outlining the price field whereby a trader can set his/her price execution level. The process and layout should be similar across most platforms.

2. Entry Orders Save Time

Forex entry orders are very useful for saving time. By setting one, traders do not need to be at a computer when a trend line is hit or when price breaks out of its price channel. Traders can very easily add an entry order to get in the trade if price behaves in the way he/she thinks it will. The order does the waiting and allows traders to focus on other things.

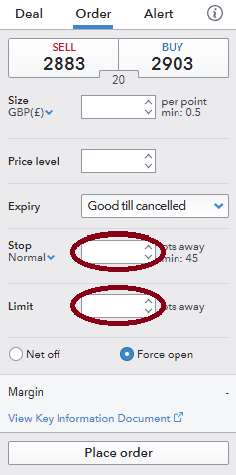

Stop and limit orders

Traders can also take things one step further by setting conditional stop and limit orders to manage a trade if the entry order is triggered while they’re not using the platform. This provides peace of mind that naked trades have not been made without managing orders attached.

To set this type of order, fill in the “Stop” and “Limit” fields on the deal ticket when placing a forex entry order (see image below).

Stops and limits set in this manner are not active until the entry order is triggered and opens a trade on our account. That is, a trader does not need to worry about a stop or limit being triggered before an entry order is hit.

3. Better Money Management

Forex entry orders also help to save money. To understand this better, consider how much time traders dedicate to trading each day. 12 hours? Six hours? One hour? 10 minutes? Most probably fall near the lower end of the spectrum between 10 minutes to an hour (if we were looking at the average amount of time per day). This is because most have a day job, a family, or prior obligations to attend to.

We must now compare that amount of time to the 24-hour day that the forex market is open. If a trader spends 10 minutes a day placing trades, this means the market is being watched 0.7% of the day. If a trader spends an hour a day placing trades, he/she is watching the market about 4% of the day. Knowing this, what are the odds that a trader will be monitoring the market at a time that is optimal to physically place a trade?

The odds are probably not very good. It is much more likely that the optimal time to enter a trade will be during the other 96% of the time when a trader is away from the computer. If traders force themselves to trade during this small viewing window, they are most likely getting sub-optimal entries. Sub-optimal entries mean traders are leaving money on the table.

Traders should try to receive the most ideal price possible even though it might not be available while they are physically sitting at their computer. Entry orders can therefore give the trader the best chance of executing at the optimal price.

4. Accountability

Forex entry orders (with stops and limits attached) also help keep traders accountable. This is because they eliminate the possibility of emotions getting in the way of reliable, profitable trades, and make sure traders are following the rules to the latter.

To put this into context, before trading begins every trader should have in place a strategy with a set of rules which means they know exactly what to do in any type of situation before that situation arises. But at times, emotions (greed, fear, over-confidence, etc.) can lead traders away from their set trading plan, and this may result in them taking stabs at the market hoping to “get lucky” rather than taking a calculated risk where they believe to have an edge. Entry orders can eliminate this risk and keep traders accountable to their strategy.

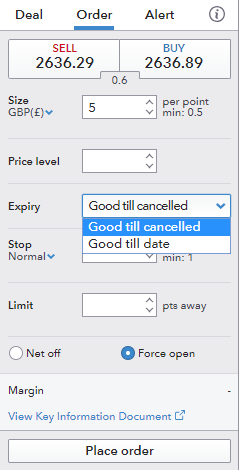

5. Support Trading on a Time Frame

Trading on a custom time frame can allow for more specified trades that could be in line with upcoming market news, political events or company results depending on what market is being traded. As seen in the image below, traders can stipulate the expiry period for the entry order:

- “Good till cancelled” – The entry order will remain active until the order is manually deleted by the trader.

- “Good till date” – The entry order will remain active up until a specified date.

RECOMMENDED READING

- If you are just starting out on your forex trading journey download our free New to Forex trading guide to learn the basics.

- We also offer a range of trading guides to supplement your forex knowledge and strategy development.

- Our research team analyzed over 30 million live trades to uncover the traits of successful traders. Incorporate these traits to give yourself an edge in the markets.