Gold Prices Hold Above $1800 on Weaker USD, Geopolitical Unrest

Gold Prices Hold Above $1800 on Weaker USD, Geopolitical Unrest

Gold Prices $1800: Gold prices extended a 4-day gain amid risk-off sentiment after Facebook earnings disappointed investors. The US Dollar fell slightly. Russia-Ukraine tensions may continue to support the safe haven.

GOLD PRICE OUTLOOK:

- Gold traded higher on Thursday as Facebook’s earnings miss drove up demand for safe haven

- Investors shrugged off Fed Chair Powell’s hawkish comments. The USD fell for a fourth day.

- Prices are eyeing $1,809 for immediate resistant, breaching which may open the door for further gains

Gold extended a four-day winning streak during Monday’s APAC mid-day session, trading at around $1,807. The risk-off sentiment appears to have driven demand for safety after Facebook reported weaker-than-expected Q4 results and a softer revenue outlook. Futures of the Nasdaq 100 index tumbled more than 2% during after-hours trade, buoying appetite for the yellow metal. Trading is quieter than usual in Asia however, as mainland China, Hong Kong and Taiwan markets are still shut for the Lunar New Year holiday.

Gold prices fell 2.36% last week after Fed Chair Jerome Powell painted a hawkish-biased outlook for rate hikes. He said that the central bank will not rule out the possibility of raising rates at every forthcoming policy meeting to rein in inflation. This is more than a market expectation of 3-4 hikes this year, resulting in sharp market reactions.

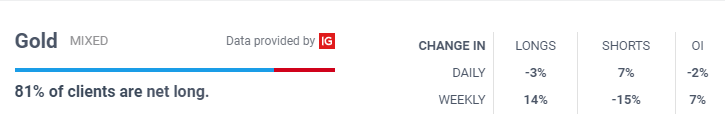

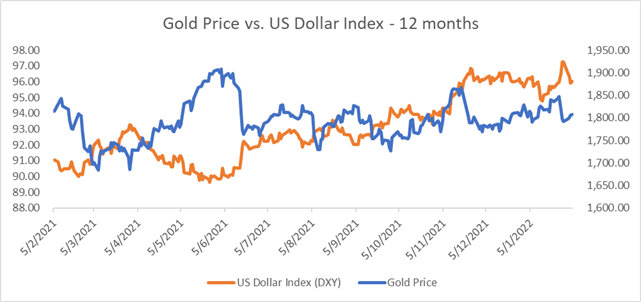

This week however, the market appears to have shrugged off a steeper curve of the Fed’s tightening trajectory, resulting in a weakening US Dollar. Gold prices have since rebounded, as a softer USD makes the yellow metal more appealing to investors holding a different currency. The DXY US Dollar index and gold prices exhibit a historically negative relationship, and their past 12-month prices are shown on the chart below.

Gold Prices vs. DXY US Dollar Index – Past 12 Months

Gold Prices $1800

Meanwhile, heightened tensions surrounding the Russia-Ukraine standoff have likely boosted demand for gold as well. US president Joe Biden has approved sending additional troops to Eastern Europe in respond to escalated geopolitical tensions in the region. The ongoing situation may continue to support gold prices until the alarm is dismantled.

Looking ahead, traders are eyeing this Friday’s US non-farm payrolls report for clues about the condition of the labor market and their ramifications for the Fed policy outlook. Some 150k nonfarm jobs are expected to be added in January, a further moderation from December’s reading of 199k. If the actual number come higher than expected, it will signal a tightened labor market and may spur the Fed to liftoff interest rates faster and quicker. In this scenario, gold price may face headwind and pull back.

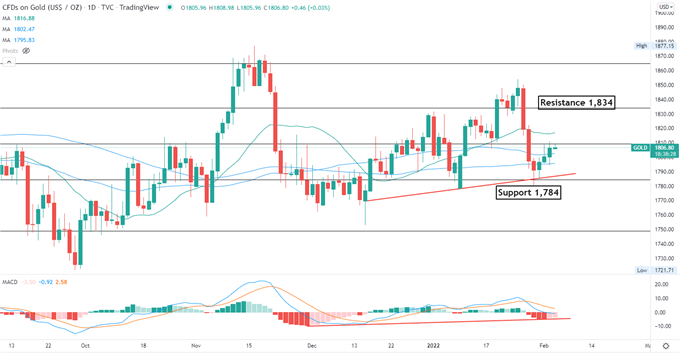

Technically, gold prices rebounded from the trendline support and edged higher. Prices are testing an immediate resistance level at around1,809 – the 50% Fibonacci retracement. Breaching above this level may open the door for further upside potential with an eye on 1,834. The MACD indicator is about to form a bullish crossover, suggesting that downward momentum may be fading.

Gold – Daily Chart

Chart created with: wavesscoutforex