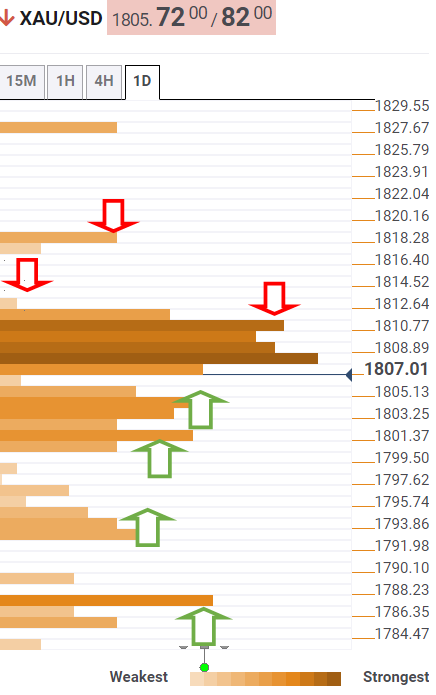

Gold Price Forecast: XAU/USD faces a wall of resistance around $1,812 – Confluence Detector

- Detector Gold Price Forecast is retreating from multi-day top but holds comfortably above $1,800.

- The US dollar rebound is weighing on gold but weaker yields could cap the losses.

- Gold awaits a sustained move above $1,815 amid favorable technicals.

Gold price extended the previous week’s upbeat momentum into a fresh on Monday. But bulls fail to sustain at higher levels amid a lack of fresh catalysts and thin liquidity. This is easing from six-day highs, courtesy of the rebound in the US dollar across the board. However, weaker Treasury yields lend support to bulls, limiting the corrective decline in the gold price. Looking ahead, the gold price will remain at the mercy of year-end flows, dynamics in the dollar, and the yields.

Detector Gold: Key levels to watch

The Technical Confluences Detector shows that the gold price is turning south after facing a wall of resistances stacked up around $1,1812.

Around that price zone, the pivot point one-day R2, Fibonacci 161.8% one-day, and the previous high four-hour coincide.

A sustained move above the latter is needed to take out the December month highs of $1,814.

Acceptance above the monthly peak will put the pivot point one-day R2 at $1,817 to test.

Alternatively, immediate support is aligned at $1,803, the confluence of the Fibonacci 38.2% one-month and SMA50 one-hour.

The next stop for gold sellers is seen at $1,800, the intersection of the SMA50 one day; Fibonacci 38.2% one week, and SMA5 one day.

If the selling pressure intensifies, then bears would target $1,792. The point of contact of the Fibonacci 61.8% one-week, SMA10 one-day, and pivot point one-week S1.

The next line of defense for XAU bulls is seen at $1,789, where the SMA100 one day appears.

Further down, the confluence of the Fibonacci 23.6% one-month and SMA100 four-hour at $1,787 will get tested.

Here is how it looks on the tool

About Technical Confluences Detector Gold

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies. Hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest; where to unwind positions, or where to increase your position size.