Q4 2020 GDP Means Nothing for the Euro, As Selling Remains Prevalent

Q4 2020 GDP Means, The Euro turned quite bearish in the last week of February, as the tensions in Ukraine increased and the sentiment turned massively bearish. Investor sentiment dived to negative levels this month in the Eurozone, with Europe being heavily affected by this conflict, especially the energy sector.

Crude oil used to be on a strong bullish trend for two years; with US WTI crude gaining around $140 from the bottom at $-37.50. But, since the beginning of this month, oil prices have picked up the pace further; as both US WTI and UK Brent crude Oil pushed above $130. Although, after the retreat lower to close the gap yesterday, the bullish momentum has picked up again today.

US WTI Crude Oil Daily Chart – The Gap Has Been Closed

Oil heading for $130 again after the pullback

The sentiment has improved somewhat, as the has said to mull a large joint-bond sale to fund energy and defence expenditures. US futures have pared losses and European stock markets have also turned around to positive levels on the day; with financial stocks rebounding strongly. It’s a step forward for the EU but like all things supposedly good for the region, it always somehow ends up stalling out or being repackaged into something else. I wouldn’t put a lot of optimism on this but we’ll see.

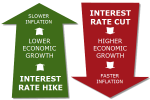

The euro has also jumped to a session high of 1.0919 from around 1.0870 earlier; helped by the headline, but we are looking to fade this retrace higher and sell this small bounce. The Eurozone GDP for Q4 of last year was released this morning, but at this point; it is old news and we will likely see a dip in Q1 of 2022.

EUR/USD H4 Chart – We’re Looking to Sell at the 20 SMA

Eurozone Q4 Final GDP From Eurostat – 8 March 2022

- Q4 2020 GDP Means, Q4 final GDP QoQ +0.5% vs +0.5% second estimate

- 2021 GDP YoY +4.6% vs +4.6% second estimate

The euro area economy expanded modestly towards the end of last year, despite a hit from the omicron spread in December. The focus now is on the outlook for the euro as the Russia-Ukraine war continues to dictate sentiment for the past few weeks.