Gold Prices Steady Amid Geopolitical Uncertainties, ETF Inflow Accelerates

GOLD PRICE OUTLOOK:

- Gold prices traded steadily as investors weighed hawkish comments from Lawrence Summers

- Geopolitical uncertainties and inflation may keep bullion prices afloat as the Ukraine war deepens

- Gold ETFs saw large net inflows over the past few weeks, underpinning buying pressure

Gold Prices Steady: Gold prices rebounded 0.3% during Monday’s APAC mid-day trading session after

falling 3.4% last

week. The Federal Reserve raised interest rate by 25 bps for the first time since 2018 and projected six

more rate hikes this year at the FOMC meeting. The prospect of monetary tightening weighed on the

non-interest-bearing metal. US CPI hit a four-decade high of 7.9% in February, urging the central bank to

tighten at a faster pace to tackle eye-watering inflation that threatened the post-pandemic economic

recovery.

Former US Treasury Secretary Lawrence Summers said the Fed will need to raise borrowing cost to 4-5%

in order to bring inflation under control. His hawkish-biased comments may limit the upside potential for gold if markets were to price in one or more 50bps rate hikes down the road. Meanwhile, investors will be eyeing Fed Chair Jerome Powell’s address at the annual meeting of the National Association for Business Economics later

today. Last week, Powell said the US economy is in good shape and strong enough to withstand monetary

tightening.

Amid Geopolitical Uncertainties, ETF Inflow Accelerates

Gold Prices Steady: Meanwhile, gold prices have been aided by ongoing conflict between Ukraine and Russia. Turkey said that Kyiv and Moscow are moving closer to strike a ceasefire agreement, while a top Ukrainian aide said

Russia had turned to “more destructive artillery.” Ukraine has rejected a Russian demand to surrender the

besieged southern port city of Mariupol. Heightened geopolitical risks may keep gold prices afloat as the

yellow metal is widely perceived as a hedge against such risks.

The ongoing Ukraine war has pushed up commodity prices, from crude oil to wheat and metals. Rising

inflation also bolstered the appeal of gold because it is widely perceived as a store of value and hedge

against rising costs as well.

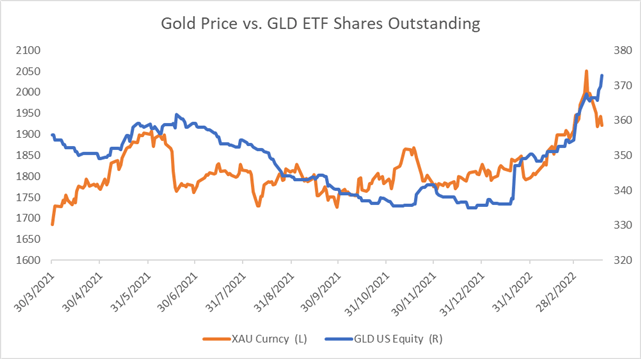

The world’s largest gold ETF – SPDR Gold Trust (GLD) – saw large among of net inflow over the last three

weeks (chart below). This suggests that more buyers are purchasing bullion amid rising geopolitical unrest.

The number of GLD shares outstanding increased 18.5 million month-to-date, with the number of holdings

hitting the highest level in 12 months. An accelerated pace of subscription to the ETF may be viewed as a

bullish signal for prices.

Gold Price vs. GLD ETF Shares Outstanding

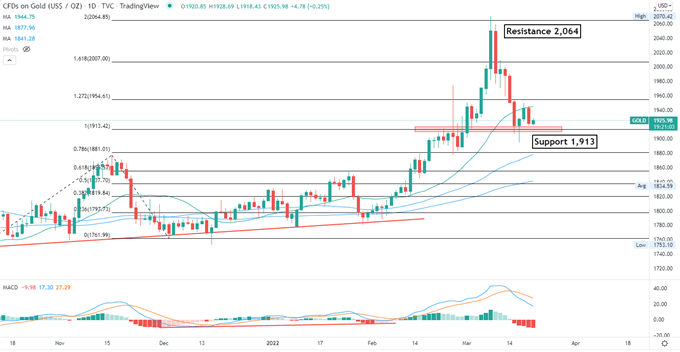

Technically, gold prices pulled back pulled back sharply from a 19-month high and entered a technical

correction. An immediate support level can be found at around 1,913, the 100% Fibonacci extension.

Breaching below this level may intensify near-term selling pressure and expose the next support level

of 1,880. The MACD indicator formed a bearish crossover and trended lower, suggesting that bearish

momentum is dominating.

Gold – Daily Chart