Sterling drops back towards 21-month lows before BoE decision

(Reuters) – The British pound fell on Thursday against a rebounding dollar before a key policy announcement from the Bank of England and after the U.S. Federal Reserve delivered its biggest rate hike in 22 years.

Reuters) – The British pound fell on Thursday against a rebounding dollar before a key policy announcement from the Bank of England and after the U.S. Federal Reserve delivered its biggest rate hike in 22 years.

Sterling drops back: BoE policymakers are expected to raise interest rates for the fourth consecutive meeting, the first such run since 1997, taking the Bank Rate to 1% from 0.75% now.

“It is a big day for UK monetary policy, where the Bank of England is expected to hike 25bp to 1.00% and potentially start discussing active Gilt sales,” said ING strategist Chris Turner.

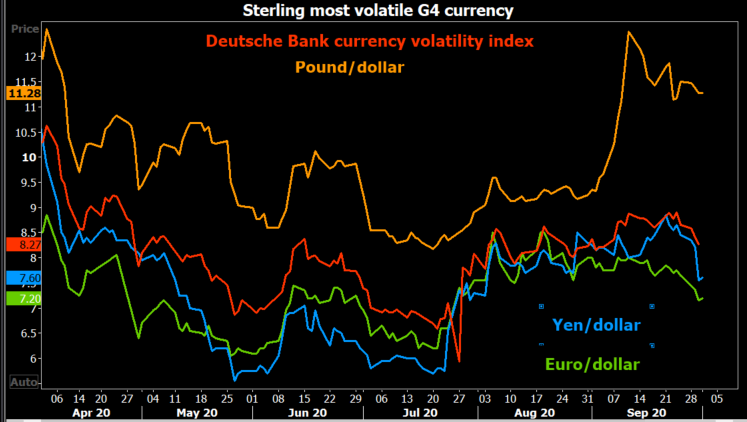

“It is probably a little too early to look for a hard sell-off in sterling on today’s meeting, but volatility looks assured,” he added in a note.

Sterling drops back

By 0749 GMT, sterling was down 0.7% against the U.S. dollar at $1.2542, reversing Wednesday’s gains and falling back towards the lowest level since July 2020, hit last week at $1.2412.

Against the euro, the pound fell 0.5% to 84.49 pence.

The pound has weakened in recent weeks on expectations that the BoE may have to slow the pace of tightening as the central bank battles with above-target inflation and a cost-of-living crisis that is showing signs of weighing on economic activity.

Sterling has also struggled against a soaring dollar, which has been supported by bets of aggressive tightening by the Fed and by its safe-haven appeal, given the growing uncertainty over the economic outlook.

On Wednesday, the Fed raised its benchmark overnight interest rate by half a percentage point.

(Reporting by Danilo Masoni in Milan; Editing by Saikat Chatterjee and Clarence Fernandez)