Bitcoin & Ethereum Price Action: How Much More Downside?

BITCOIN, BTC/USD, ETHEREUM, ETH/USD – TECHNICAL OUTLOOK:

- Bitcoin and Ethereum have pulled back recently from strong resistance.

- BTC/USD and ETH/USD have plenty of support, likely limiting the downside.

- What are the key levels to watch?

Bitcoin & Ethereum Price Action: Bitcoin and Ethereum have fallen sharply over the past couple of weeks, and chances are cryptocurrencies could decline further in the near term. However, it may be premature to assume that the multi-week-long rebound is over.

BITCOIN

Bitcoin has pulled back sharply from near key resistance area: the May 2022 high of 32375, and an uptrend line from January, coinciding with the 89-week moving average – a risk highlighted in the previous update. See “Bitcoin Crosses the Key $30000 Mark: Will it Sustain?”, published April 11.

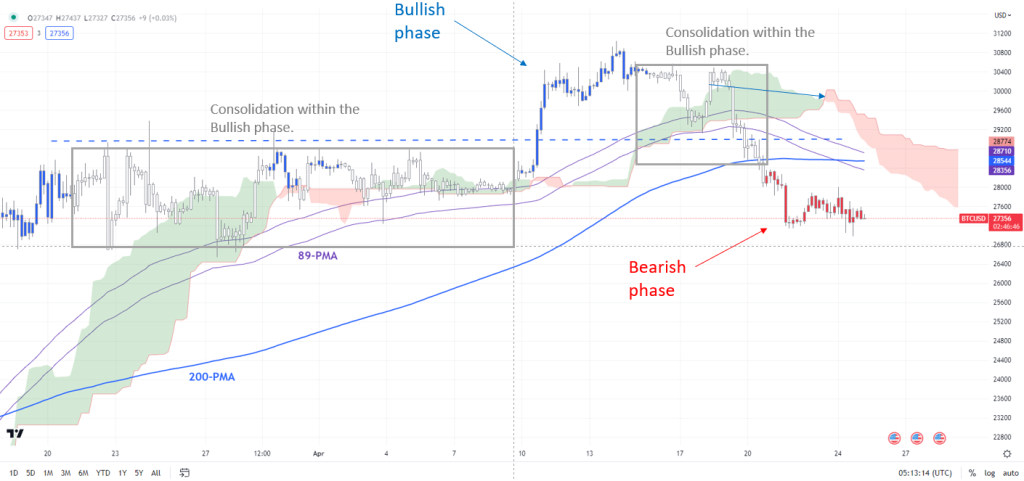

BTC/USD 240-minute Chart

Bitcoin & Ethereum Price Action

Note: In the above colour-coded chart, Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, or around a support/resistance and/or in sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

The upward pressure has eased somewhat following the drop below support at the end-March high of around 29000. This is further reinforced by the colour-coded candlestick charts, based on trend/momentum indicators, on the 240-minute charts –BTC/USD has entered a bearish phase in the intraday timeframe.

BTC/USD Daily Chart

The downward momentum could push BTC/USD toward initial support at the end-March low of 26525. Beyond that, further downside could be limited given plenty of cushions: the 89-day moving average and the lower edge of the Ichimoku cloud on the daily charts, near the February highs of 24250-25250.

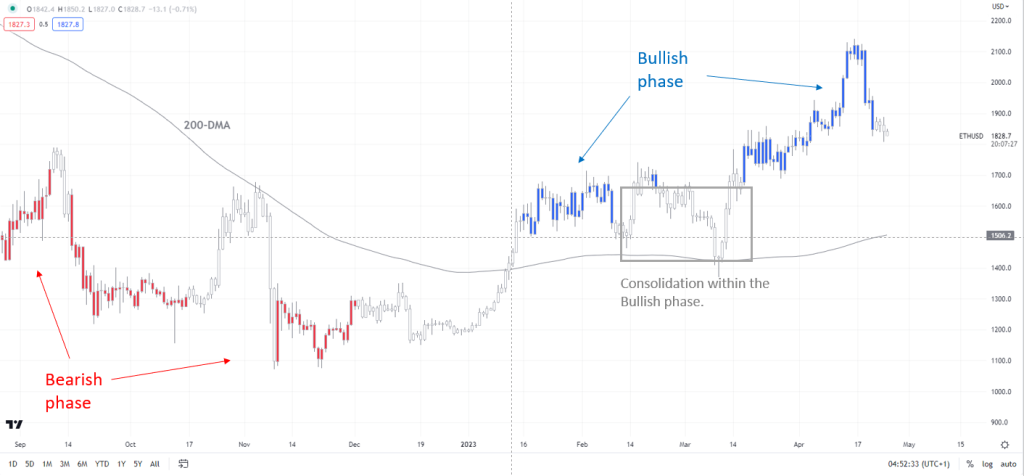

ETH/USD Daily Chart

Bitcoin & Ethereum Price Action: Note: In the above colour-coded chart, Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, or around a support/resistance and/or in sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Notwithstanding the recent retreat, the broader trend remains up on the daily charts – a trend that has been prevalent since January – see “Bitcoin Technical Outlook: BTC/USD Turns Bullish”, published January 18. Hence, for the five-month-long uptrend to reverse, BTC/USD would need to fall below strong support at the March low of 19540.

ETHEREUM

The technical posture in ETH/USD is similar – bullish on the daily charts, as the colour-coded candlestick charts show. Ethereum has pulled back from a fairly strong ceiling at the August high of 2030.

ETH/USD Daily Chart

Still, there is a strong converged cushion on the 89-day moving average, the lower edge of the Ichimoku cloud on the daily chart, and a horizontal trendline from February at about 1715. Unless ETH/USD falls below the 1350-1500 area, including the 200-day moving average and the March low, the broader trend continues to be up.