USD/JPY Price Analysis: Clings to 124.00 as bulls aim to break the YTD high at 125.10

- The USD/JPY ended the week on the right foot, gaining 1.42%.

- High US Treasury yields underpinned the USD/JPY pair.

- USD/JPY Price Forecast: The pair is upward biased, but it might correct courtesy of RSI showing overbought conditions.

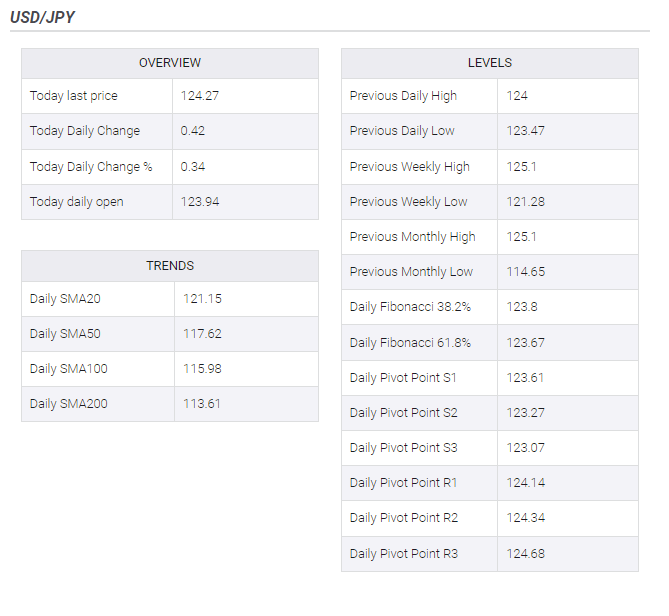

USD/JPY Price Analysis: The USD/JPY is set to finish the week above the 124.00 mark for the first time in the year, though short of the YTD high at 125.10, amid a mixed market mood and upward pressured US Treasury yields. At the time of writing, the USD/JPY is trading at 124.27

US equities closed mixed, portraying the market sentiment. US Treasury yields rose, led by the 10-year benchmark note rate up to four and a half basis points, sat at 2.706%, a tailwind for the USD/JPY due to its positive correlation. If yields rise, the USD/JPY pair does it too.

On Friday, the USD/JPY opened around 123.90 but then fell towards the mid-pòint between the S1-Daily pivot point at 123.67, a price level where bulls took charge and lifted the pair towards fresh weekly highs at 124.67.

USD/JPY Price Forecast: Technical outlook

The USD/JPY remains upward biased. The daily moving averages (DMAs) reside well below the spot price, confirming the uptrend. However, the Relative Strenght Index (RSI) at 76.15 is aiming higher and at overbought levels, which means that the pair might be headed towards a correction before resuming up.

If the scenario of a lower correction plays out, the USD/JPY’s first support would be 124.00. A decisive break would expose 123.67. Once cleared, the next support would be March 244 daily high at 122.41.

Upwards, the USD/JPY’s first resistance will be 125.00, which once breached would send the pair towards the YTD high at 125.10, followed by June 2015 cycle highs near 125.85, and then the April 2001 swing high around 126.85.

USD/JPY Price Analysis