British Pound (GBP/USD) – Trying to Build Support Ahead of Inflation Data

GBP/USD PRICE, CHART, AND ANALYSIS

- UK headline inflation will continue to print fresh multi-decade highs.

- Cable eyes 1.3350 area as next level of resistance.

GBP/USD Trying Support: Inflation in the UK is expected to hit 8%, or higher, in the coming months as

sharply higher energy

prices and rising import costs push prices higher across a range of products and services. The Bank of

England (BoE) warned last week that UK headline inflation that they expect inflation to hit 8% this

Spring, and said that it could go higher later this year. The BoE expects inflation to be around their 2%

target in two to three years’ time.

With the bank of England already raising interest rates to try and control sky-high price pressures, the BoE is now looking at the potential effect these hikes may have on growth. Recent ONS data showed UK growth back above pre-pandemic levels with all sectors contributing positively to the January figures. The BoE however are concerned that the recent strength in the UK economy may fizzle out as multi-year high energy prices dampen demand. The UK central bank has a tricky path to navigate in the coming months balancing the need to fuel growth at the same time as pouring water on red-hot price pressures.

For all market-moving economic data and events, refer to the wavesscoutforex

GBP/USD has twice bounced of a 1.3000 low in recent days and this support should hold any short-term attempt to push the pair lower. Cable currently sits on an old horizontal support level, and this needs to be reaffirmed if the pair are to move higher. Above here, 1.3353 comes into play. The overall technical picture for cable however remains negative with lower highs and lower lows dominating the daily chart. All three simple moving averages are also in a bearish formation. A short-term move higher may be on the cards but the pair will have to move substantially higher to turn the technical picture

GBP/USD DAILY PRICE CHART –

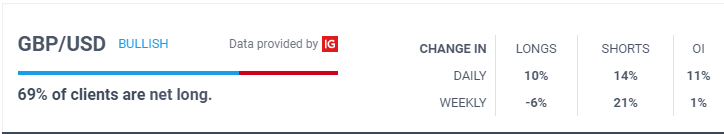

Retail trader data show 69.84% of traders are net-long with the ratio of traders long to short at 2.32 to

1. The number of traders net-long is 6.63% higher than yesterday and 7.49% lower from last week,

while the number of traders net-short is 9.52% higher than yesterday and 22.67% higher from last

week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests

GBP/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared

with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon

reverse higher despite the fact traders remain net-long.

What is your view on GBP/USD – bullish or bearish?? You can let us know via the form at the end of

this piece or you can contact the author via telegram: @wavscfrx