AUD/USD, AUD/JPY Climb as Risk-On Flows Bolster Asian Equities

AUSTRALIAN DOLLAR, AUD/USD, AUD/JPY, RUSSIA, HANG SENG INDEX, BANK OF JAPAN – TALKING POINTS

- Australian Dollar rises amid heavy equity buying across US and Asian stock markets

- Oil prices climb after China signals it may start to reduce its aggressive Covid strategy

- AUD/USD momentum may carry prices above 0.7400, which would expose the March high

FRIDAY’S ASIA-PACIFIC OUTLOOK

AUD/USD Climb as Risk: Asia Pacific traders will look to close the week out on a high note today after Wall Street traders

pushed US indexes higher for the third day. The benchmark S&P 500 index gained 1.23%. Asian equity

markets also have the advantage of upward momentum. Hong Kong’s Hang Seng Index (HSI) closed

over 7% higher on Thursday. The resumption of negotiations between Ukraine and Russia has lifted

market sentiment, but fighting in Ukraine has only intensified, according to reports on the ground.

Commodity markets remain highly volatile despite the bullish activity in equity markets. WTI crude oil

rose back above 100 per barrel overnight. Brent crude – the global benchmark – rose as well. Oil was on the move amid a new wave of Covid-induced lockdowns. However, Chinese President Xi asked policymakers to reduce the impact of Covid on the Chinese economy on Thursday, according to Xinhua News.

AUD/USD Climb as Risk

The foreign exchange market has seen heavy risk-on flows. AUD/JPY – a common FX risk gauge – rose to its highest level since early February 2018. Meanwhile, the safe-haven US Dollar fell for a third day via the DXY index, with Euro strength accounting for much of that drop. Gold was also advantaged from the weaker USD, which pushed spot prices over half a percent higher.

The Dollar did gain against the Russian Ruble, with USD/RUB rising nearly 7%. S&P cut Russia’s credit rating to CC from CCC-. The credit rating agency warned that another cut is possible. The Bank of Japan (BoJ) will provide today’s main event to close out the week. Analysts expect the central bank to hold steady on providing massive monetary support.

AUSTRALIAN DOLLAR TECHNICAL FORECAST

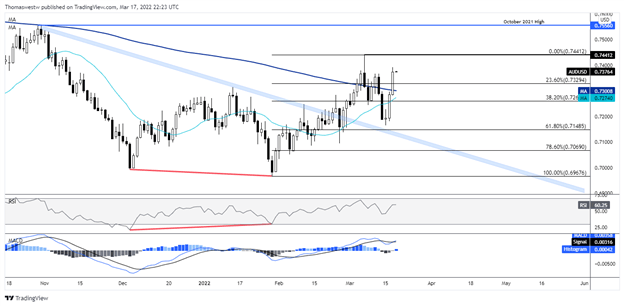

AUD/USD is trading just below the 0.7400 level after a third daily gain. A push above that level would open the door for a test of the March high at 0.7441. MACD is tracking back above its signal line, and the 20-day Simple Moving Average (SMA) is nearing a cross above its 200-day SMA. If prices pullback, the 23.6% Fibonacci retracement may offer a degree of support.

AUD/USD DAILY CHART