US Dollar Forecast: Emerging Market FX Resilient. Eyes on Fed, PCE and China PMI

US DOLLAR, SINGAPORE DOLLAR, THAI BAHT, INDONESIAN RUPIAH, PHILIPPINE PESO, ASEAN, FUNDAMENTAL ANALYSIS – TALKING POINTS

- US Dollar mostly lower against ASEAN currencies despite volatility

- Wall Street had it worse versus Emerging Markets amid PBOC easing

- Key event risk: Federal Reserve, PCE data, China PMI, Philippine GDP

US DOLLAR ASEAN WEEKLY RECAP

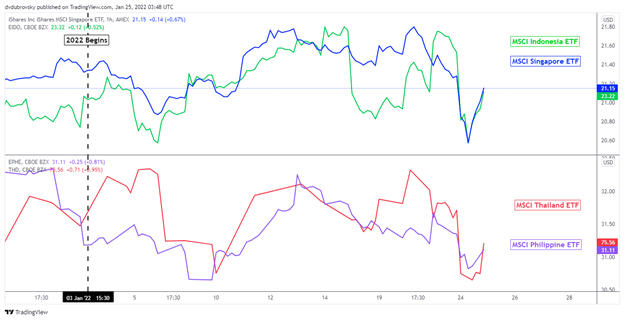

US Dollar Eyes on Fed: Last week, the US Dollar weakened against some of its ASEAN counterparts. The Singapore Dollar, Thai Baht and Philippine Peso managed to appreciate as the Indonesian Rupiah fell slightly behind. This comes despite cautious selling pressure in most ASEAN stock markets – see hourly chart below. What might explain this relationship, and will it continue?

MSCI ASEAN INDICES 1-HOUR CHART

RESILIENT ASEAN CURRENCIES

US Dollar Eyes on Fed: Global market sentiment continued to deteriorate this past week, with losses on Wall Street reverberating outwards. The S&P 500 declined 5.68%, seeing the worst weekly performance since worldwide markets tumbled amid the onset of the pandemic. Emerging Markets were also hit last week, but not as rough as Wall Street. The MSCI Emerging Markets Index weakened 2.22%.

ASEAN and Emerging Market currencies can be sensitive to risk appetite as capital flows into and outside of developing regions. As such, if market volatility continues to simmer, then pairs like USD/SGD, USD/THB, USD/IDR and USD/PHP may see some upward forces. However, there may also be some dynamics at play offering these currencies some breathing space.

China’s central bank, the PBOC, has eased monetary policy to help a slowing economy. China is a key trading partner for Singapore, Thailand, Indonesia and the Philippines. Efforts from the world’s second-largest economy to bolster growth could reverberate to the ASEAN region, perhaps boosting some of their currencies.

There are also unique characteristics for certain countries. Thailand’s economy relies more on tourism and a gradual global reopening could boost local revenue expectations. Meanwhile in Singapore, the city-state economy has a well-established financial sector, which could benefit from a rising interest rate environment around the world. The Monetary Authority of Singapore also just tightened policy.

AESAN EVENT RISK – FED, US PCE DATA, PHILIPPINE GDP, CHINA PMI

US Dollar Eyes on Fed: Given the sensitivity of ASEAN currencies to capital flows, it will be important to keep an eye out for a couple of key economic event risk from the United States. The first is Wednesday’s Federal Reserve rate decision, where traders will get further insight into the central bank’s approach for tightening monetary policy this year. About four rate hikes are priced in, alongside expectations of quantitative tightening.

Then, PCE data will cross the wires on Friday, which is the Fed’s preferred gauge of inflation. Another strong print could uphold hawkish policy bets. Over the weekend, China will release January manufacturing PMI data. A softer outcome could induce further PBOC easing bets. USD/PHP may also see some volatility from fourth-quarter Philippine GDP data on Thursday.

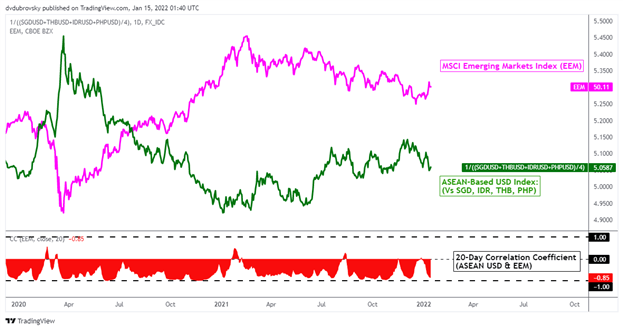

On January 24th, the 20-day rolling correlation coefficient between my ASEAN-based US Dollar index and the MSCI Emerging Markets Index changed to -0.36 from -0.81 one week ago. Values closer to –1 indicate an increasingly inverse relationship, though it is important to recognize that correlation does not imply causation.

ASEAN-BASED USD INDEX VERSUS EEM INDEX – DAILY CHART

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/THB and USD/PHP