Euro Technical Analysis: Next Leg Lower Beginning? Setups for EUR/GBP, EUR/JPY, EUR/USD

EURO OUTLOOK:

- Technical evidence is accumulating that the Euro’s resiliency is in the rearview mirror.

- A false bullish breakout may have transpired in EUR/USD rates, while both EUR/GBP and EUR/JPY rates have already started to push towards their monthly low.

- Per the IG Client Sentiment Index, each of the major EUR-crosses have a different bias.

PERIOD OF RESILIENCE ENDING

Euro Technical Analysis: The Euro’s period of strength and resiliency at the start of 2022 may quickly be coming to an end. While EUR/USD rates experienced a bullish breakout earlier this week, there is growing evidence that the move is set to reverse. Coupled with a failure by EUR/GBP rates to advance meaningfully and EUR/JPY rates falling to fresh monthly lows, it may be the case that EUR/USD strength has masked problems elsewhere. With fundamental problems still abound – mainly, the European Central Bank’s refusal to raise rates in the face of high inflation – a fresh wave of Euro selling could be ahead.

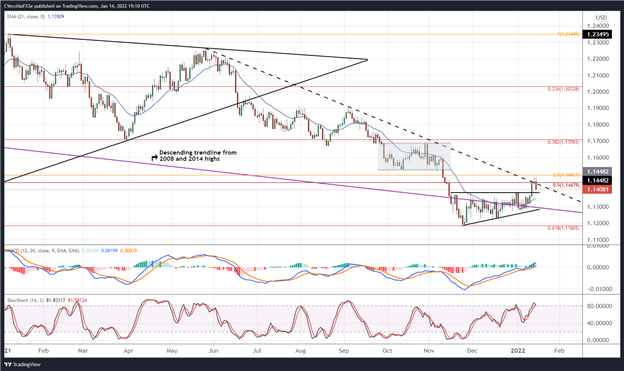

- EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (JANUARY 2021 TO JANUARY 2022) (CHART 1)

EUR/USD rates broke out higher from their two month-long triangle earlier this week, but did not advance meaningfully before resistance was met in a number of forms: the descending trendline from the May and September 2021 swing highs; the 50% Fibonacci retracement of the 2017 low/2018 high range; and the 50% Fibonacci retracement of the 2020 low/2021 high range. But perhaps most notably, the daily candlestick on Friday has taken the shape of a bearish outside engulfing bar, and coming in after a breakout, means its also a bearish key reversal. A move back below 1.1380 would offer a strong confirmation signal that EUR/USD’s bullish breakout as failed.

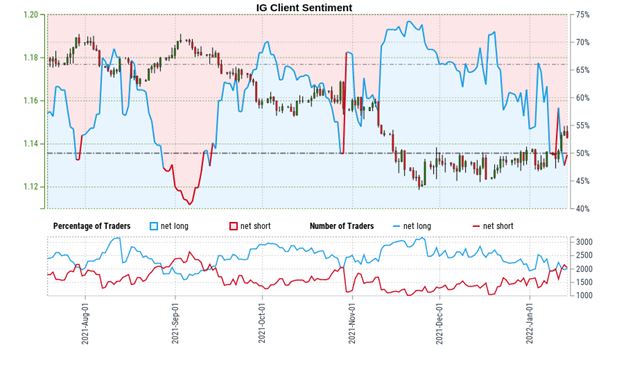

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (JANUARY 14, 2022) (CHART 2)

EUR/USD: Retail trader data shows 48.99% of traders are net-long with the ratio of traders short to long at 1.04 to 1. The number of traders net-long is 8.45% lower than yesterday and 13.32% lower from last week, while the number of traders net-short is 2.84% lower than yesterday and 17.10% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Euro Technical Analysis: Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

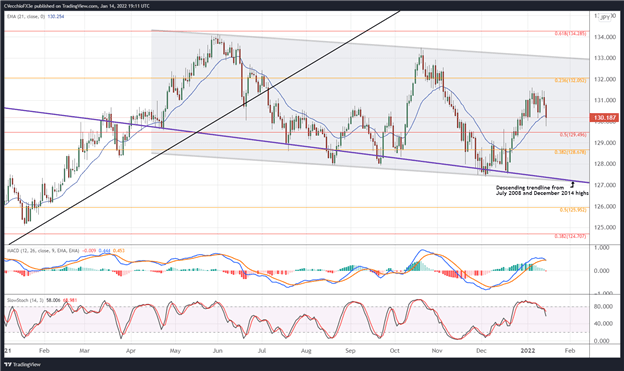

- EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (JANUARY 2021 TO JANUARY 2022) (CHART 3)

EUR/JPY rates failed to achieve their double bottom target at 131.92, and with the pair breaking back below their daily 21-EMA while seeing fresh monthly lows, a more bearish move seems likely in the near-term. Momentum indicators are quickly turning lower, with daily MACD issuing a sell signal (albeit above its signal line). Daily Slow Stochastics are dropping from overbought territory. The 50% Fibonacci retracement of the 2014 high/2016 low range at 129.50 is the first target lower, following by the 38.2% Fibonacci retracement of the 2018 high/2020 low range at 128.68.

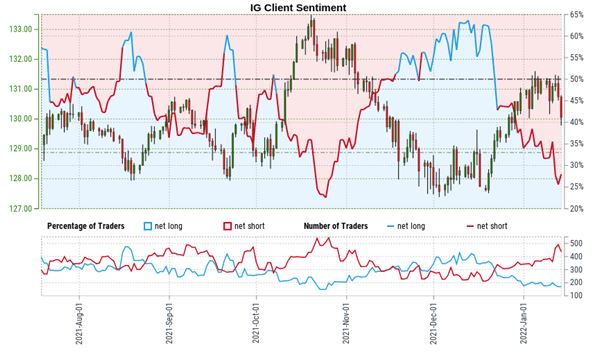

IG CLIENT SENTIMENT INDEX: EUR/JPY RATE FORECAST (JANUARY 14, 2022) (CHART 4)

Euro Technical Analysis: EUR/JPY: Retail trader data shows 33.33% of traders are net-long with the ratio of traders short to long at 2.00 to 1. The number of traders net-long is 8.98% higher than yesterday and 15.74% lower from last week, while the number of traders net-short is 29.32% lower than yesterday and 2.15% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/JPY trading bias.

EUR/GB PRATE TECHNICAL ANALYSIS: DAILYCHART (JANUARY 2021 TO JANUARY 2022) (CHART 5)

EUR/GBP rates continue to hold below former channel support that was carved out between March and December 2021, unable to climb back above the 2021 low at 0.8368. It would thus appear that price action in 2022 has been accumulating into a sideways range, a flagging pattern whose preceding move to the downside suggests further losses in the coming sessions. It remains that the case that “further losses towards 0.8282 seem likely in the near-term.”

IG CLIENT SENTIMENT INDEX: EUR/GBP RATE FORECAST (JANUARY 14, 2022) (CHART 6)

EUR/GBP: Retail trader data shows 80.88% of traders are net-long with the ratio of traders long to short at 4.23 to 1. The number of traders net-long is 1.28% higher than yesterday and 12.80% higher from last week, while the number of traders net-short is 3.02% lower than yesterday and 1.75% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.