Gold Price Outlook: Fed Hiking Cycle Impact on Gold

- Fed Rate Hikes On The Way In 2022

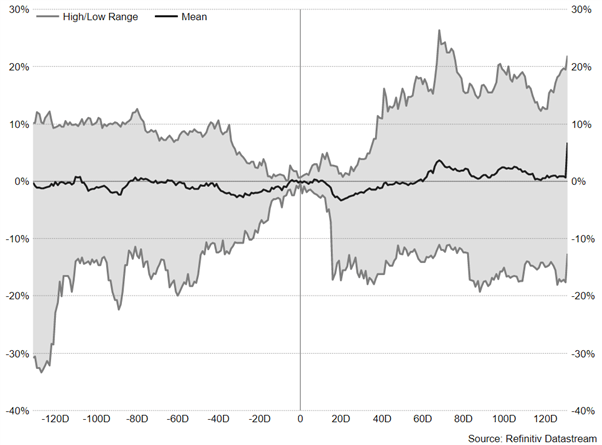

- Gold Struggles In the Run Up Into the First Fed Rate Hike

Gold Price Outlook, In a year where inflation has hit over three-decade highs, gold has struggled throughout much of the year, with the yellow metal down over 4% YTD. This comes amid sticky and not so transitory inflation pressures forcing the Federal Reserve to remove emergency stimulus much quicker than markets had expected. Therefore, dampening the appeal for gold, particularly with real yields finding a bottom.

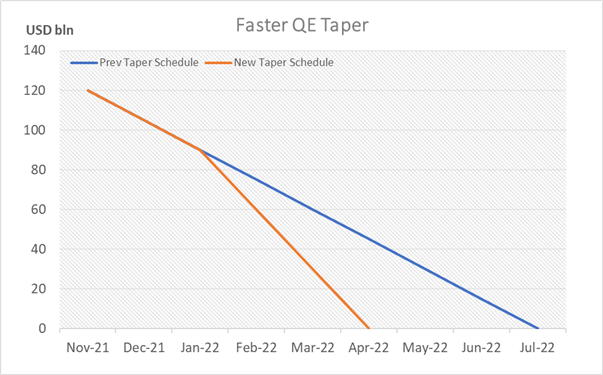

At the December meeting, the Federal Reserve announced that it would double the pace of its QE taper (Figure 1.), which in turn brought forward expectations of a Fed rate hike. Those expectations were further bolstered by the central bank shifting its dot plots to project three rate rises from the prior of one, which was also more hawkish than the market consensus call of two 2022 rate rises.

Figure 1. New Fed Taper Schedule Signals Fed Rate Hike Sooner Rather Than Later

Source: Refinitiv

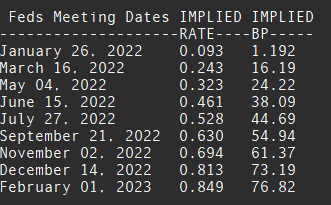

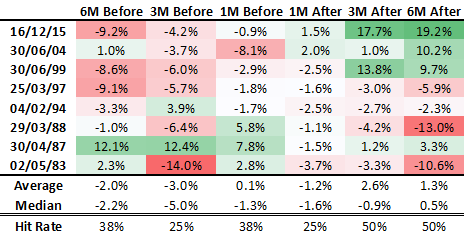

Taking a look at Fed Fund Futures, the first-rate hike from the Bank is near fully priced in for May. Therefore, if we use current market pricing for liftoff as our reference date i.e 6 months times. The table below highlights the 6-month return in gold heading into the first Fed rate hike and the 6-month return after liftoff.

Gold Price Outlook: Fed Futures See First Rate Hike in May

Source: Refinitiv

As seen below, gold struggles in the run-up into the first hike with an average fall of 2% before picking up in the following 6-month period.

Gold Performance 6 Months Before and After the First Fed Rate Hike

Source: Refinitiv, wavesscoutforex