Gold Soars to $1,859 – Brace for a Bearish Correction

Gold Soars, Happy Friday, traders. The precious metal gold enters the overbought zone as it’s trading at 1,865. Yesterday, gold prices closed at $1864.20 after setting a high of $1868.65 and a low of $1845.10. Gold continued its bullish momentum and rose for the sixth consecutive session on Thursday, despite the renewed strength in the US dollar. The US Dollar Index (DXY) that measures the greenback’s value against the basket of six major currencies rose for the second consecutive session on Thursday and extended its gains by reaching 95.20, its highest in 16 months. The yield on the benchmark 10-year note in the United States remained low throughout the trading session, hovering around 1.57%

Gold has been rising towards new peaks over the past few sessions after major central banks indicated last week that interest rates would remain low in the near term, with the Federal Reserve maintaining its stance that inflation was transitory. However, since then, Fed officials have raised concerns about longer-lasting inflation.

Gold Soars

The positive momentum across the yellow metal started to gain further strength after the release of the US Consumer Price Index, which rose 6.2% for the 12 months through October. It was the fastest growth of the CPI since November 1990, driven mostly by the increased fuel prices that had reached seven year highs. The US market was closed on Veterans Day on the data front on Thursday, resulting in no macroeconomic data release and leaving the dollar to follow the previous daily momentum. At 00:00 GMT; the Federal Budget Balance dropped to -165.1B against the anticipated 180.3B and weighed on the US dollar; further bolstering the precious metal prices.

Meanwhile, Chinese leader Xi Jinping has said that China was ready to manage differences with the United States ahead of a planned virtual meeting with US President Joe Biden. The first-ever meeting since Biden took the presidency earlier this year will be held next week. Xi has expressed the intention of enhancing exchange and cooperation across the board with the US to bring relations between the two world powers back on track. He said that China-US relations were at a critical historical juncture and called on the two sides to bring bilateral relations back on the right track of sound and steady development. The uncertainty about the future of U.S.-China relations kept the risk-off market sentiment alive and drove gold prices higher.

Gold Soars to $1,859 – What’s Next?

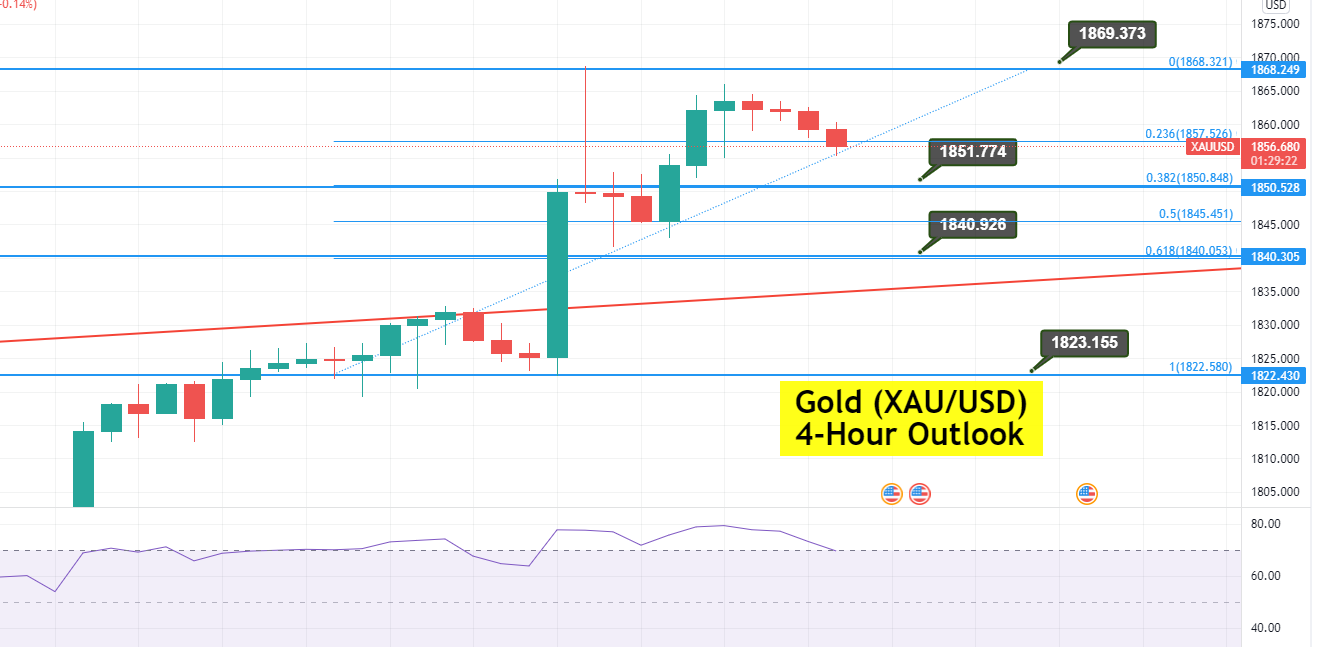

Gold is trading at the 1,859 level, facing strong resistance at the 1,865 level. On the 4-hour timeframe; XAU/USD is trading with a bullish bias, having violated the upward channel which is now suggesting a strong bullish trend in gold. However, the precious metal has now entered the overbought; zone and may exhibit a bearish correction. On the lower side, the XAU/USD’s immediate support prevails at 1,850 which is extended by 38.2.% Fibonacci retracement level. Further breakout of 1,850 can lead the gold; prices towards 1,845 and 1,840 levels.

Daily Technical Levels

Support Resistance

1849.99 1873.54

1835.77 1882.87

1826.44 1897.09

Conversely, the resistance level stays at the 1,865 level; and the violation of this level exposes the metal towards the 1,869 level. The RSI and stochastic are in an overbought zone, and the closing of candles below the 1,865 level exposes the metal price; towards the 1,850 level. Let’s consider taking a sell trade below 1,865 and buy above the same. Good luck!