Short Selling Currency Explained

Short selling currency involves taking positions under the pretence of a bearish sentiment. Historically short selling has been used under negotiated contracts; however in current financial markets short selling has spread to almost every financial instrument with the most prevalent occurring in the forex market. Short selling is used by traders to hedge currency exposure; or simply to profit from forecasted analysis.

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

WHAT DOES SHORT SELLING CURRENCIES INVOLVE?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

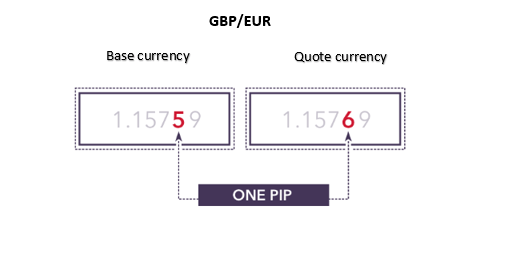

In the forex market, transactions are handled differently to stocks which means the process of short selling a currency pair is very different. Firstly, a currencypair involves a base currency and quote currency as seen in the image below. Each currency is provided as a ‘two-sided transaction.’When you short sell a currency pair, you are effectively selling the base currency and buying the quote currency in expectation that the value of the of the currency pair will fall.

HOW TO SHORT FOREX: EUR/USD SHORT SELLING EXAMPLE

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

Want to sell the EUR/USD?

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit – excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

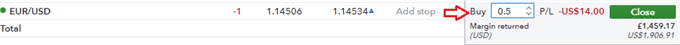

The trader that is short $100 000 EUR/USD can then manually enter in 0.5; then click on the ‘Close’ button to begin the trade closing process of 50 k; offsetting half of the 100 k short position that was previously held; see image below.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.AUG 96:30 AM +04:30

LOOKING TO TRADE SHORT? FILTER FOR DOWNWARD TRENDS!Cross-Market Weekly OutlookRegister for webinar

HOW TO MANAGE THE RISK OF SHORT SELLING CURRENCIES

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

- Implement stop losses.

- Monitor key levels of support and resistance for entry/exit points.

- Stay up to date with the latest economic news and events for potential downside risk.

- Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders; when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets; however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application; and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

FURTHER READING RECOMMENDATIONS

- Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

- At DailyFX we researched over 100,000 live IG Group accounts to find out the secrets of successful traders and published the findings in our Traits of Successful Traders.

- Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

- We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

- To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

If you would like to get much from this paragraph then you have

to apply these methods to your won web site.