European Central Bank: Rising interest rates depend on September inflation.

AMSTERDAM (Reuters) – European Central Bank President Christine Lagarde said on Thursday that if the bank’s September inflation projections put the pace of price growth in 2024 at 2.1% or higher, the bank will raise interest rates by more than 25 basis points.

European Central Bank: – European Central Bank President Christine Lagarde said on Thursday that if the bank’s September inflation projections put the pace of price growth in 2024 at 2.1% or higher, the bank will raise interest rates by more than 25 basis points.

“We must stay the course and be determined to contain inflation,” Lagarde told reporters in Amsterdam after the bank’s monetary policy meeting.

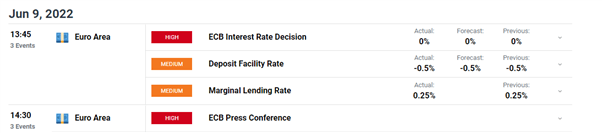

ECB HOLDS RATES, EYES 25 AND 50 BPS HIKES IN JULY AND SEPTEMBER

The ECB held true to its forward guidance and sequencing whereby it foresaw a rate hike only after APP comes to an end, meaning July is when we are very likely to witness lift-off.

European Central Bank:

Investors are expecting the ECB to join the Federal Reserve and some other major central banks in raising its interest rates by 50 basis points in one go at some point – a bigger increment than has been usual since the global financial crisis.

Money market pricing suggests the ECB will hike rates by 75 basis points over its next two meetings, implying at least one hike worth more than the quarter of a percentage point that chief economist Philip Lane described as a “benchmark”.

The Austrian, Dutch, Latvian and Slovak central bank chiefs have all recently said that a 50 basis-point rate hike should be on the table this summer.

But the central bank governors of Italy and Spain, two of the euro zone’s most indebted countries, have struck a more cautious tone, calling for gradual increases.

PERTINENT POINTS OF THE 9 JUNE ECB MEETING:

- Rates left unchanged but the ECB intends to raise by 25 basis points in July

- ECB intends to reinvest, in full, principal payments of maturing securities under both APP and PEPP. PEPP reinvestments to continue until end of 2024 at a minimum while leaving APP reinvestments open-ended. Purchases under PEPP could be resumed if necessary to counter negative shocks related to the pandemic.

- Real Annual GDP growth: 2.8% 2020, 2.1% in 2023 and 2.1% in 2024

- ECB Inflation forecast 6.8% in 2022, 3.5% in 2023 and 2.1% in 2024

- “If medium-term inflation outlook persists/deteriorates, a larger than 25 bps hike will be appropriate for the September meeting”

EUR/USD rose in the lead up to the announcement, shot below 1.070 and subsequently recovered and is trading right where it was moment before the news.

EUR/USD 5 Minute Chart