The International Monetary Fund raises the dollar and the Chinese yuan in the SDR basket

BEIJING, May 15 (Reuters) – The International Monetary Fund said on Saturday it has increased the weighting of the dollar and Chinese yuan in its review of the currencies that make up the valuation of its Special Drawing Rights (SDR), an international reserve asset.

The International Monetary: The International Monetary Fund lifted the yuan’s weighting in the Special Drawing Rights currency basket, prompting the Chinese central bank to pledge to push for a further opening of its financial markets.

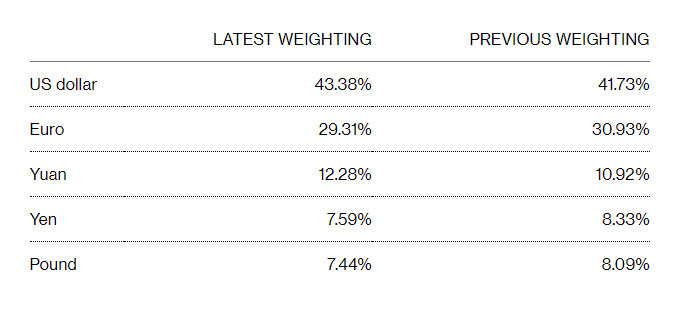

The IMF raised the yuan’s weighting to 12.28% from 10.92% in its first regular review of the SDR evaluation since the Chinese currency was included in the basket in 2016, the People’s Bank of China said in a statement Sunday. The weighting of the US dollar rose to 43.38% from 41.73%, while those of euro, Japanese yen and British pound declined.

The PBOC and other regulators “will continue to resolutely push for the opening up of China’s financial markets and further simplify the process of overseas investors coming into the Chinese market,” it said in the statement.

SDRs are an international reserve asset that can be converted into five currencies. The yuan’s entry into the SDR signaled it became one of the five global reserve currencies in 2016, after years of effort by Chinese authorities to promote its global use.

BEIJING (Reuters) – The International Monetary Fund said on Saturday it has increased the weighting of the dollar and Chinese yuan in its review of the currencies that make up the valuation of its Special Drawing Rights (SDR), an international reserve asset.

The review is the first since the yuan, also known as the renminbi, joined the basket of currencies in 2016 in what was a milestone in Beijing’s efforts to internationalise its currency.

The IMF raised the U.S. currency’s weighting to 43.38% from 41.73% and the yuan to 12.28% from 10.92%. The euro’s weighting declined to 29.31% from 30.93%, the yen’s fell to 7.59% from 8.33% and the British pound fell to 7.44% from 8.09%.

The International Monetary

The IMF said in a statement its executive board had determined the weighting based on trade and financial market developments from 2017 to 2021.

“Directors concurred that neither the COVID-19 pandemic nor advances in Fintech have had any major impact on the relative role of currencies in the SDR basket so far,” the IMF said.

Although the yuan’s value has declined recently, it has risen roughly 2% against the dollar since 2016, and appreciated about 6% against its major trading partners.

In a statement on Sunday, the People’s Bank of China said China will continue to promote the reform and opening of its financial market.

The change came amid a sharp depreciation of the yuan since late April, as it faces a double whammy of slowing domestic growth because of Covid-induced lockdowns and capital outflows due to its widening monetary policy divergence with the US. The PBOC set its reference rate for the yuan at a stronger-than-expected level for a ninth straight day on Friday, underpinning its support for the currency.

In its statement on Sunday, the PBOC vowed to extend the interbank foreign exchange trading time, make more types of assets available and improve information disclosure in order to provide better investment conditions to global institutions.

The ranking of the currencies’ weighting remains the same after the review, according to an IMF statement released late Saturday, with the yuan continuing to be in third place. The change will be effective Aug. 1, and the next review will be in 2027, according to the statement.

IMF’s executive directors concurred that neither the pandemic nor developments in financial technology have had any major impact on the relative role of currencies in the SDR basket so far, according to the statement. The current review is taking place about a year later than originally scheduled due to the virus, the IMF said.