AUD/USD Eyes Chinese Trade Balance as Zero-Covid Strategy Continues

AUSTRALIAN DOLLAR, AUD/USD, CHINA TRADE BALANCE, CPI, SENTIMENT – TALKING POINTS

- China’s April trade balance may set the tone for sentiment in APAC trading

- CPI inflation data out of China and the United States is in focus this week

- AUD/USD may test the May low after bulls struggled to maintain gains

MONDAY’S ASIA-PACIFIC FORECAST:

AUD/USD Chinese Trade: A wave of risk aversion hit global financial markets last week, sending major equity indexes lower amid surging government bond yields. The US Dollar gained against many of its peers after traders digested the Federal Reserve’s policy decision. However, the Australian Dollar managed to stay afloat thanks to a hawkish surprise from the Reserve Bank of Australia. China’s trade balance is due out today, with analysts expecting to see the country’s surplus rise to $51.90 billion from 47.38 billion, according to a Bloomberg survey. The data will give insight into China’s supply chain woes as it battles to contain Covid outbreaks across key economic hubs.

Asia-Pacific traders will also be closely monitoring developments out of China this week, which could have an outsized impact on the Aussie Dollar, given the trade relationship between Australia and China. The People’s Bank of China may opt to cut lending rates within the economy over the coming weeks after a group of high-ranking Communist Party officials vowed to hold firm on the country’s “Zero-Covid” policy.

AUD/USD Chinese Trade

China’s consumer price index (CPI) for April is due out later this week. Analysts expect to see the month-over-month rate of inflation climb to 1.9% from 1.5% on a year-over-year basis, according to a Bloomberg survey. That would be the highest level since November 2021. A weaker-than-expected print would give the PBOC more leeway to enact accommodative policy to aid the economy. The figure will also help economists gauge global inflationary pressures. The United States is set to release its own CPI report this week.

Stocks in China and Hong Kong fell last week, and that trend may continue in the days ahead as markets calibrate to rising bond yields. Last week, NIO, the major Chinese electric vehicle maker, was added to a list for potential delisting from US exchanges by the SEC. The move renewed worry in China’s technology sector. Indonesia’s first-quarter gross domestic product (GDP) growth is seen crossing the wires at 5.0% on a y/y basis. That would be down slightly from 5.02%.

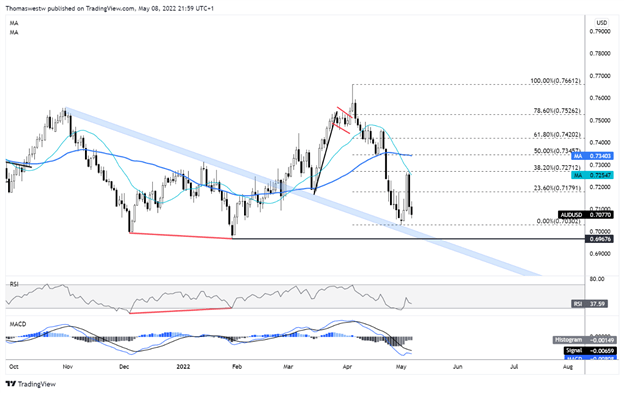

AUD/USD TECHNICAL FORECAST

AUD/USD managed to climb last week, but much of pair’s upside was trimmed going into the weekend. The May swing low at 0.7030 may give way if bears continue to pressure prices. The 2022 low at 0.6967, the 0.7000 psychological level, and a descending trendline may offer a degree of confluent support if the May low breaks.

AUD/USD DAILY CHART