USD/JPY Price Forecast: BoJ Favors Yen Weakness, Bull Run to Continue

JAPANESE YEN, USD/JPY NEWS AND ANALYSIS

- BoJ Governor Kuroda favors yen appreciation despite expressing caution around the drawbacks

- USD/JPY to rise further on the back of comments, 125 in sight

- IG client sentiment remains heavily net-short but signs of short covering emerge

BOJ’S KURODA FAVORS YEN WEAKNESS

USD/JPY Price Forecast: The Bank of Japan’s Governor Kuroda mentioned that a weak yen pushes up the value of Japan firm’s profits earned overseas, which helps boost capital expenditure and wages. He continued to state that the weak yen is positive for the Japanese economy as a whole.

Concerns were raised that the benefits of the yen weakness could be uneven across industries and that a weak yen negatively impacts household’s real income and firms that are reliant on imports. On the whole, the comments have been viewed in a positive light with regard to the current USD/JPY bull run despite the pullback.

KEY USD/JPY TECHNICAL LEVELS

Ever since breaking above 116, USD/JPY has soared as Japan’s terms of trade worsen due to rising raw material and commodity prices. 120 was surpassed with ease before breaching 121.85. This morning we have witnessed a pullback which could be representative of profit taking and appears to present an opportunity to re-enter the bullish trend from lower levels. The pair is coming back from oversold conditions which could signal that further room to the upside may become available.

A break and close on the daily chart above 121.85 would see 124.15 appear as resistance. Support seems quite a distance away at 120.

USD/JPY Daily Chart

USD/JPY Price Forecast: The monthly chart helps identify the potential level of resistance with respect to the recent bullish momentum. A conservative approach would be to look at the 124.15 level ahead of the psychological 125.00 level which may prove a stretch too far.

USD/JPY Monthly Chart

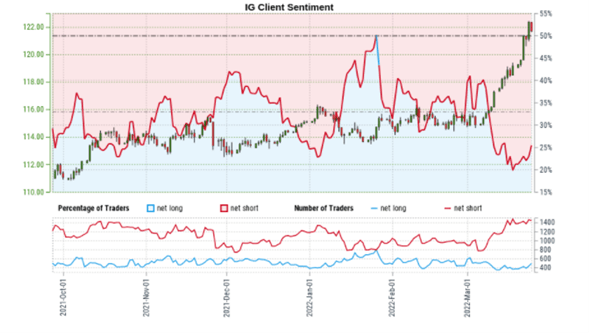

CLIENT SENTIMENT MIXED, AS SIGNS OF SHORT COVERING EMERGE

It is an unfortunate observation that retail clients, on aggregate, appear to fight trends in search of reversals. Such a conclusion can be reached when analyzing strong trending markets against retail client sentiment and the current uptrend in USD/JPY is no different. Take a look at the guide below for more insights on how to interpret consumer sentiment.

Traders are way more net-short than net-long (3.5 times more) but developments over the last week as net-longs pick up, suggest we could start to see the gap closing. With clients heavily short, rising prices may cause traders to ‘buy to close’ – resulting in an increase in longs.

- USD/JPY: Retail trader data shows 21.39% of traders are net-long with the ratio of traders short to long at 3.67 to 1.

- The number of traders net-long is 4.08% lower than yesterday and 4.17% higher from last week, while the number of traders net-short is 0.68% higher than yesterday and 0.48% higher from last week.

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

- Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.