Japanese Yen Outlook: JPY Remains Bearish But Beware of Rising Intervention Risks

Japanese Yen Analysis and News

- Yen Bearish For Rest of the Month

- Intervention Risk to Grow on a 120 Break

- Buy the Rumour, Sell the Fact for USD

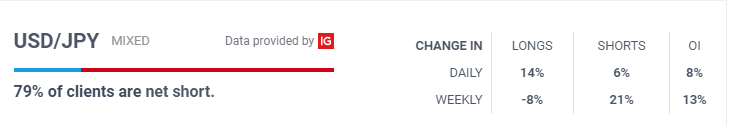

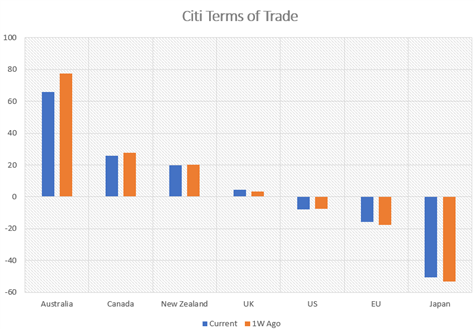

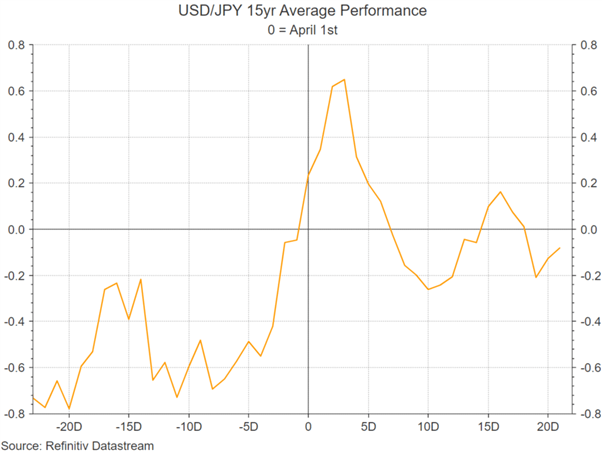

JPY Remains Bearish: Price action in the Japanese Yen remains bearish as USD/JPY and cross-JPY showing little signs of pulling back. There have been several reasons as to why the Japanese Yen has received little support. Firstly, the energy shock has worsened Japan’s terms of trade (as shown below), keep in mind that Japan is a net energy importer. Additionally, with global central banks either raising rates or signalling an intention to raise rates, wider rate differentials have weighed against the Japanese Yen. As such, USD/JPY continues to track US 10yr yields in lockstep. Elsewhere, seasonal factors are also extremely bullish USD/JPY, in which the pair has had a tendency to ramp higher into the end of the month, before peaking in the first week of April. Subsequently, I remain bearish Yen for the rest of the month and will look to reassess in the first week of April, should there be signs of an overshoot.

Worsening Terms of Trade Weighs on Japanese Yen

Source: Refinitiv

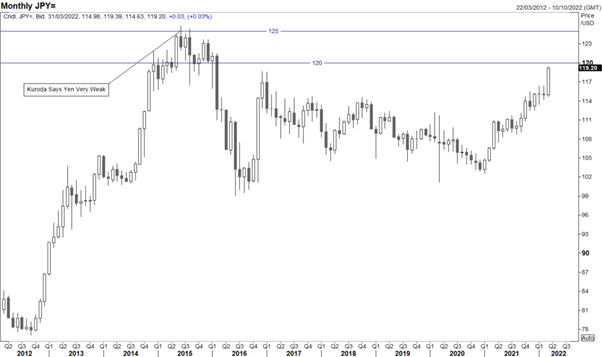

JPY Remains Bearish: Now while I have mentioned several factors explaining why the Japanese Yen can keep selling off in the short run. With USD/JPY comfortable above 119.00, the key barrier to watch is the 120 figure, which if breached would put me on high alert for intervention risks. This could be the catalyst to prompt USD/JPY to continue tracking its seasonal pattern and peak in the first week of April.

At the beginning of the year, sources familiar with the BoJ’s thinking had grown concerned over the government’s possible reaction if USD/JPY hit 120. To add to this, with the Japanese PM Kishida recently stating that “the yen’s weakening trend could add burden to consumers through higher import costs”. Intervention risks will grow should the pair break 120. However, while the threshold of concern for the government nears, it does appear to be some distance away from the BoJ’s threshold, previously at 125.

USD/JPY Chart: Monthly Time Frame

Fed Hike Appears to be a Buy the Rumour/Sell the Fact

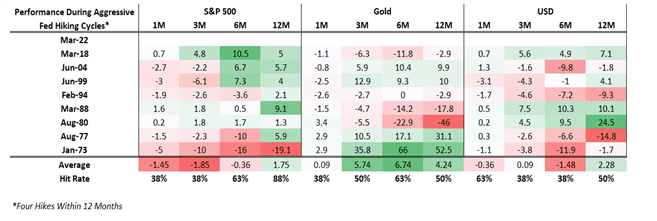

As had been well documented, given the empirical evidence, the first Fed hike appears to be a buy the rumour, sell the fact type price action. Now while this is more notable during recent hiking cycles, this is also true in the more aggressive hiking cycles, albeit less so. However, the big caveat on this front is the ongoing geopolitical tensions. That said, unless progress is made regarding peace talks, it will be difficult for the USD to experience a material pullback.

Prior Aggressive Fed Hiking Cycles

USD/JPY