Gold Prices Moving to the Ebb and Flow of Geopolitics

Gold Prices Moving, Spot gold continues to hover around the $1900 psychological mark and will likely remain elevated as long as geopolitical tensions persist. Conditions associated with the; Russian invasion of Ukraine are constantly changing in via both political and financial aspects, leaving global markets switching from risk; on to risk off. Bullions safe-haven characteristic is allowing; for gold prices to stay buoyed despite fluctuating conditions.

A weaker dollar this morning contributed to XAU/USD; upside but may be dwarfed by the upcoming Federal Reserve rates meeting. Due to the U.S. being geographically isolated from the war in Europe, the dollar and U.S. economy has been comparatively secluded by the ongoing conflict. The Fed may continue on its hawkish path with many pundits anticipating a 50bps rate hike later this month.

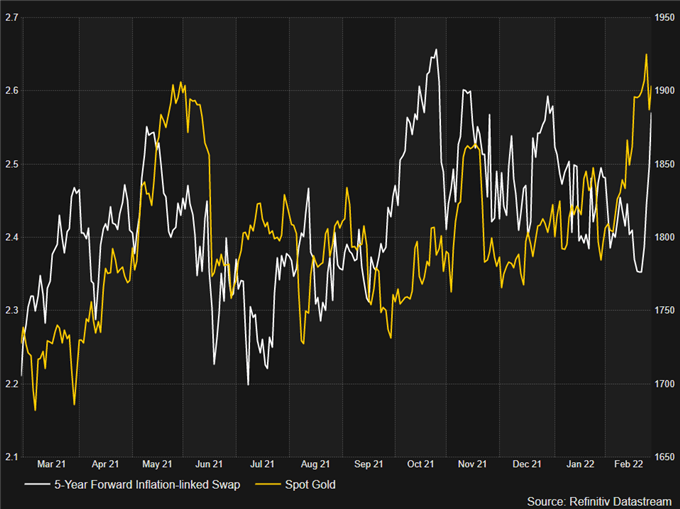

Inflation pressures are being compounded with oil prices; on the rise and may play into golds inflation hedge trait (contentious as it may be). The chart below shows inflation expectations over the next five years averaging around 2.6% and of recent shows quite a strong positive correlation with gold.

Source: Refinitiv

Gold Prices Moving, TECHNICAL ANALYSI

Daily XAU/USD price action has found it tough to push above the current resistance zone (blue) barring the last weeks invasion. Prices are extended to the upside according to the RSI but bears remain cautious in the midst of the ongoing war. Forecasts are difficult at the current juncture but should the war dissipate; we could see downward pressure on gold prices as the Fed looks to tighten monetary policy.RECOMMENDED BY WARREN VENKETASGet Your Free Gold ForecastGet My Guide

Resistance levels:

- 2000.00

- 1959.45

Support levels:

- 1900.00

- 20-day EMA (purple)

- 1850.00

IG CLIENT SENTIMENT BEARISH

IGCS shows retail traders are currently distinctly long on gold; with 73% of traders currently holding long positions (as of this writing). At DailyFX; we typically take a contrarian view to crowd sentiment however; due to recent changes in long and short positions we end up with a mixed disposition.