Gold Price Forecast: Russia Sanctions Trigger Rebound, Volatility Surge – Levels for XAU/USD

- Gold Price Forecast: Russia Sanctions, Gold prices are back above 1900 – but a return back to all-time highs requires greater escalation between Russia and the West.

- It remains the case that more upside is possible as the Russia-Ukraine crisis unfolds, but its likely that the 2022 high has been established.

- According to the IG Client Sentiment Index, gold prices retain a bearish bias in the near-term.

RECOMMENDED BY CHRISTOPHER VECCHIO, CFAGet Your; Free Gold ForecastGet My Guide

SANCTIONS TRIGGER VOLATILITY SURGE

Gold Price Forecast: Russia, Last week it was noted that “further upside is still possible, but it stands to reason that gold prices; have already carved out their apex.” Gold prices have since rebounded from last week’s; low below 1880 to trade around 1910 at the time this report was written. The aggressive sanctions against Russia by the European Union and the United States have ratcheted tensions higher as Russia presses forward; with its invasion of Ukraine. The core thesis remains: it’s World War 3 or bust if gold prices are going to have any chance at a return to their highs set last week.

GOLD VOLATILITY SURGE SUPPORTING RISE BY GOLD PRICES

Historically, gold prices have a relationship with volatility unlike other asset classes. While other asset classes like bonds and stocks don’t like increased volatility – signaling greater uncertainty; around cash flows, dividends, coupon payments, etc. – gold tends to; benefit during periods of higher volatility. The ongoing war in Eastern Europe has continued to push gold volatility, translating into higher gold prices.

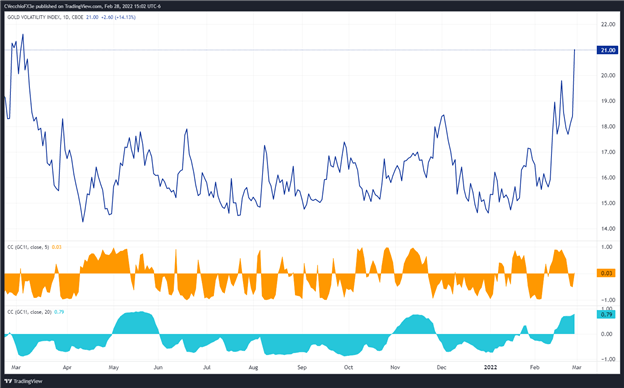

GVZ (GOLD VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (FEBRUARY 2021 TO FEBRUARY 2022) (CHART 1)

Gold volatility (as measured by the Cboe’s gold volatility ETF, GVZ, which tracks the 1-month implied volatility of gold as derived from the GLD option chain) was trading at 21.00 at the time this report was written; now the highest level since March 2021. The 5-day correlation between GVZ and gold prices; is +0.03 while the 20-day correlation is +0.79. One week ago, on February 17; the 5-day correlation was +0.53 and the 20-day correlation was +0.71.

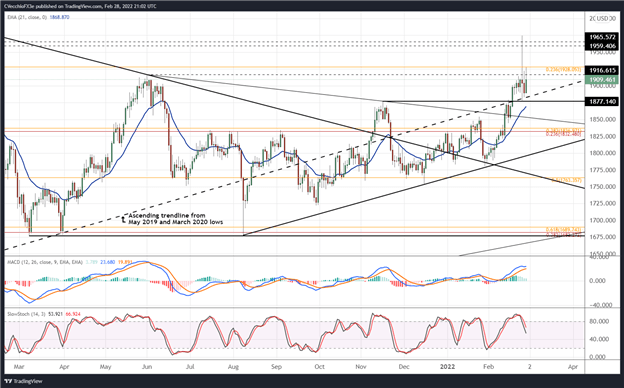

GOLD PRICE RATE TECHNICAL ANALYSIS: DAILY CHART (FEBRUARY 2021 TO FEBRUARY 2022) (CHART 2)

Last week it was noted that “it’s worth noting that the daily candle appears to be shaping up as a shooting star with a long upper wick, suggesting that a new range between 1916.62 and 1974.49 may emerge. A drop below 1916.62 would likely only transpire once Russian troops vacate Ukrainian territory.” This was obviously a miscalculation with the benefit of hindsight, but its worth noting that gold prices failed to overcome 1916.62 on Friday and today; suggesting that markets don’t necessarily believe that the Russian invasion of Ukraine will; continue for an extended period of time.

It still remains the case that “another push higher is still possible in the near-term, with gold prices above their daily 5-, 8-, 13-, and 21-EMA envelope; which is in bullish; sequential order.” But it’s worth nothing that daily MACD’s move higher while above its signal line is fading, and daily Slow Stochastics have plunged; out of overbought territory. Any news of a Russia-Ukraine ceasefire could provoke a sharp pullback.

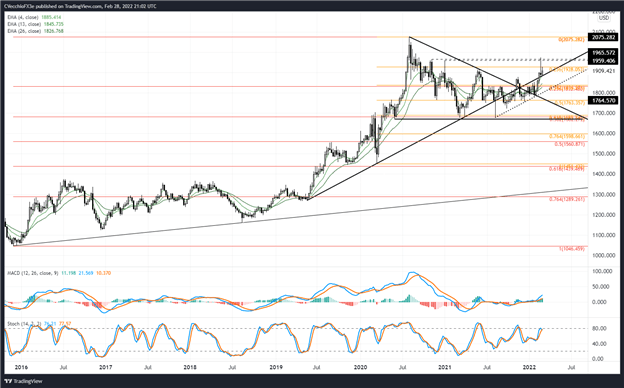

GOLD PRICE TECHNICAL ANALYSIS: WEEKLY CHART (OCTOBER 2015 TO FEBRUARY 2022) (CHART 3)

Nothing has changed over the past few days for the longer-term technical outlook. “The longer-term technical outlook has taken on a more bullish tone, suggesting that another push higher towards 1974.49 can’t be ruled out in the near-term. Gold prices are above their weekly 4-, 13-, and 26-EMA envelope; which is in bullish sequential order. Weekly MACD is trending higher while above its signal line, and weekly Slow Stochastics have; advanced into overbought territory. Given the long upper wick on the weekly timeframe, it stands to reason that resistance held (despite the overshoot).” Fading any rallies makes sense so long as NATO doesn’t; formally enter the Russia-Ukraine conflict. RECOMMENDED BY CHRISTOPHER VECCHIO, CFAB uilding Confidence in Trading Get My Guide

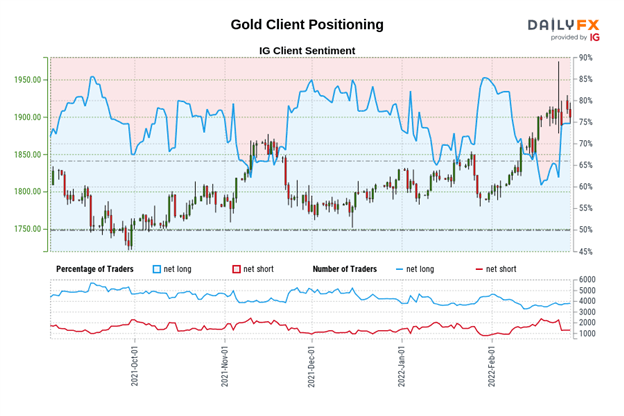

Gold Price Forecast: Russia, IG CLIENT SENTIMENT INDEX: GOLD PRICE FORECAST (FEBRUARY 28, 2022) (CHART 4)

Gold: Retail trader data shows 75.39% of traders are net-long with the ratio of traders; long to short at 3.06 to 1. The number of traders net-long is 6.37% higher than yesterday and 7.69% higher from last week, while the number of traders net-short is 2.20% higher than yesterday and 39.84% lower; from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Traders are further net-long than yesterday and last week; and the combination of current sentiment and recent changes gives us a stronger Gold-bearish; contrarian trading bias.

— Written by Christopher Vecchio, CFA; Senior Strategist