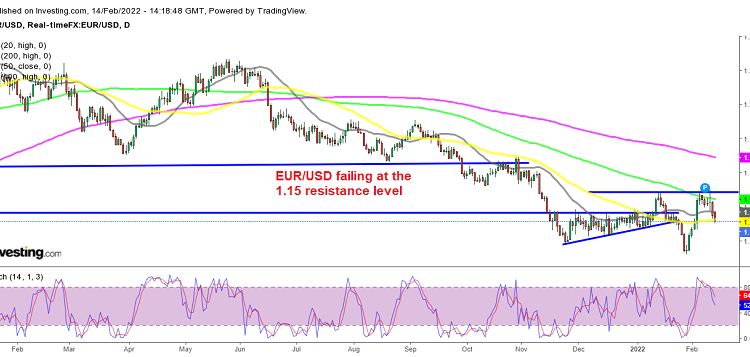

EUR/USD, GBP/USD Turn Bearish as FED Eyes 50 bps Rate Hike

EUR/USD, GBP/USD Turn, The US Dollar has been riding on the back of the FED, and turning hawkish since summer last year, as inflation continued to surge, increasing above 5% back then. Now, CPI (consumer price index) inflation has increased above 7%, and there is no slowing down. As a result, the USD has been bullish, although we saw a retreat earlier this year, after other central banks turned hawkish as well.

The Bank of England (BOE) has hiked interest rates twice in the last two meetings, by 40 basis points (bps), which supported the GBP, while the European Central Bank is ending the PEPP stimulus program. But, the FED is ahead of the rest of the central banks, as inflation is much higher in the US, so after the retreat in previous weeks, the USD is now gaining ground again.

GBP/USD Daily Chart

The 200 SMA has turned into resistance for GBP/USD

EUR/USD failed to push above 1.15, and it has now reversed back down, heading for 1.10. That big round level, together with the 100 SMA (green) on the daily chart, did a great job in providing resistance for this pair. GBP/USD is holding on better, as seen in the chart above, but the 200 daily SMA (purple) has turned into resistance here, so this pair remains bearish below that moving average. The hawkish comments by the FED keep coming in. Below are the remarks by the George and Bullard of the FED:

Remarks by Kansas City Fed President, Esther George

- EUR/USD, GBP/USD Turn, What we have to do is be systematic

- Too soon to say if March would see 50 bps rate hike

- It is always preferable to go gradually, I’d be hard-pressed to say we have got to get to neutral really fast

- But strong inflation and market pricing pave the groundwork for discussion

- If we get to March and the data says we should talk about it, then a 50 bps rate hike will be in play

- But “I am not sure that is the answer”

- Does not see the current situation as an emergency, inflation printout was not a surprise

She also talked up reducing the balance sheet and says that any combination of policy tools used to combat inflation and low unemployment would have to be ‘systematic’ in that sense. Judging by her tone, she doesn’t seem too eager to push for a 50 bps rate hike – at least for now – but she isn’t shutting the door on it either.

Comments from by St Louis Fed President Bullard

- I think we need to front-load the removal of accommodation

- Notes that he will defer to Powell

- Says he will try to convince his colleagues about his position

- Says he is taking the last four inflation reports as a whole

- Inflation is higher than any time it was during the Greenspan era

- Doubles down on the idea of 100 bps by July 1

- The Fed needs to follow through and ratify market expectations

- Typical comment from his contacts is that supply chain disruptions will last all the way through 2022 and into 2023

- We’re going to need the runoff to start very soon

- We have a long ways to go to be restrictive

- We could end up in a pickle if we don’t do something in the next couple of months

- Would like to see balance sheet steepen the yield curve

- I would like a Plan B as using asset sales, if necessary

- How selling bonds would work is an open question and that could put more upward pressure on the longer end

- I would be happy, at this point, to start with a passive runoff

- Everyone I talk to is scrambling for workers and I expect to see that reflected in wages

Treasury yields are moving significantly higher, as he doubles down on the idea of 100 bps by July 1. The headlines might not have captured the full flavour of the comments. He said it sheepishly, highlighting that he will defer to the Fed chair.