Goldman Sachs and Netflix Earnings Eyed as S&P 500 Faces “Reality Check

Goldman Sachs and Netflix Earnings Eyed as S&P 500 Faces “Reality Check

Goldman and Netflix Earnings: The Dow Jones, S&P 500 and Nasdaq 100 indices consolidated at the start of 2022, weighed by the rapid spread of the Omicron variant of Covid-19 and expectations that the Fed may kick off a rate-hiking cycle as early as March. Several Fed members expressed hawkish-biased views recently, supporting the narrative of three to four rate hikes this year after December’s inflation reading reached a four-decade high of 7%.

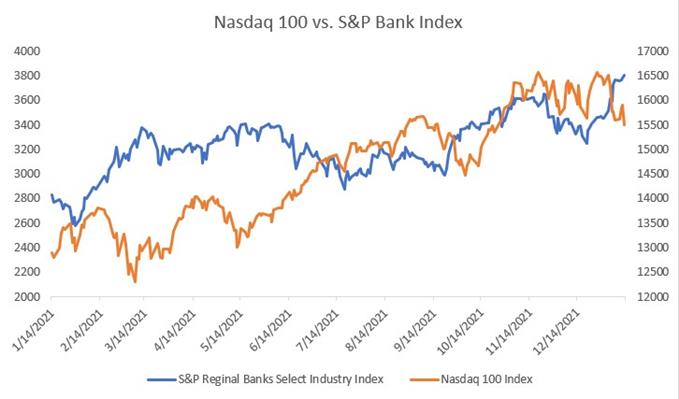

Though this has dampened appetite for the technology stocks, the financial sector has outperformed. Big banks are likely to benefit from widening interest rate margins and a broad recovery in the economy. While the Nasdaq 100 index has been range-bound over the past four weeks, the S&P index of regional banks soared 16% (chart below). This rally could carry on if big banks such as Goldman Sachs and Bank of America deliver positive earnings surprises next week.

Goldman and Netflix Earnings: According to Factset, the S&P 500 is expected to deliver a broad earnings growth rate of 21.8% YoY for the fourth quarter, marking the fourth straight quarter of earnings growth above 20%. The actual growth rate could be even higher as the majority of corporate America tends to give conservative EPS forecasts in an attempt to engineer positive surprises when realized results are published. Higher EPS readings may effectively bring down the price-to-earnings (PE) ratio for the S&P 500 index, paving the way for it to drive deeper into record territory.

Big corporates such as Goldman Sachs, Procter & Gamble, Bank of America, Morgan Stanley and Netflix will start to release their results in the week ahead. Here is a brief preview:

MAJOR US EARNINGS EPS FORECAST – WEEK 17-21 JAN

Goldman and Netflix Earnings: Goldman Sachs:

- EPS of $11.65 and revenue of $12 billion expected for Q4

- Strong investment banking and trading fees expected against the backdrop of robust volume and trading activity

- Competitive strength may fuel a solid start to 2022 for the institutional segment

- Revenue expected to be up 2% YoY, EPS may fall 4%

Bank of America:

- EPS of $0.755 and revenue of $22.23 billion expected for Q4

- Potential rate hikes may boost forward guidance to its net interest income outlook for 2022

- Management has been optimistic on balances in recent weeks

- Trading and investment banking fees should be solid

Morgan Stanley:

- EPS of $1.939 and revenue of $14.44 billion expected for Q4

- Rising asset prices should have bolstered wealth and asset management business

- Institutional revenue growth should be driven by robust advisory revenue

Netflix:

- EPS of $0.894 and revenue of $7.71 billion expected for Q4

- Stock price may be lifted if new subscribers surpass the company’s guidance of 8.5 million

- The company may reach its goal of 18.4 million new users for the full year

- The company expects free cash flow to break even

Stay tuned for more earnings in the weeks to come: