Gold Prices Eyeing $1,816 as Japanese and Chinese Data Beat Expectations

- Gold prices traded flat at around $1,816 on Monday after rising 1.6% last week

- Japanese machinery orders expanded at 11.6%, Chinese GDP grew 4.0% – both beat expectations

- Gold prices are eyeing $1,834 for immediate resistance, breaching which may open the door for further gains

Gold Prices Eyeing $1816: Gold held steadily during Monday’s APAC session after gaining 1.6% over the past week. A slew of upbeat economic data bolstered risk sentiment, defying fears about the negative impact of the Omicron variant on economic recovery. This may limit upside potential for the yellow metal, which is commonly viewed as a safe haven asset.

Japan’s core machinery orders, a leading indicator of capital spending, surged 11.6% YoY in November. This compared to a 6.1% estimate. The reading reflects an encouraging sign that private firms are spending and the broader economy is recovering at a faster-than-expected pace.

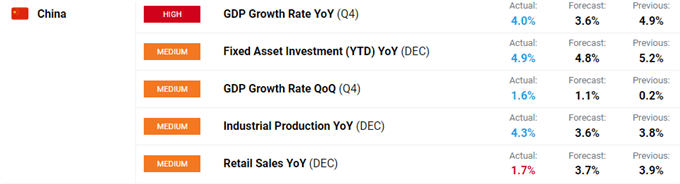

Chinese GDP expanded at 4.0% in the fourth quarter, beating economists’ forecast of 3.6%. industrial production grew at 4.3%, compared to a 3.6% estimate. Retail sales trailed behind consensus however, coming in at 1.7% YoY. Nonetheless, the overall picture shows that the world’s second- and third-largest economy are in a good shape of recovery, although the roadmap remains bumpy due to lingering effects of the pandemic.

Economic Calendar

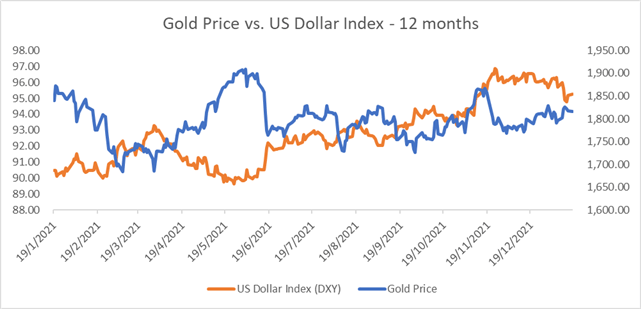

Gold Prices Eyeing $1816: The DXY US Dollar Index is flat during Monday’s APAC trade, offering little clue about gold. The US markets are shut for a holiday on Monday, so trading volume may be lighter than usual. Gold prices are negatively correlated with the US Dollar. Their past 12 months of performance are highlighted below.

Investors have weighed the outlook for tightening monetary policy as US inflation rates run into four-decade highs. Although gold is perceived as a good inflation hedge, rising interest rate expectations have limited upside potential. This is because gold is a non-yielding asset, and it is likely to lose its appeal to investors in a rising interest rate environment.

Gold Prices vs. DXY US Dollar Index – Past 12 Months

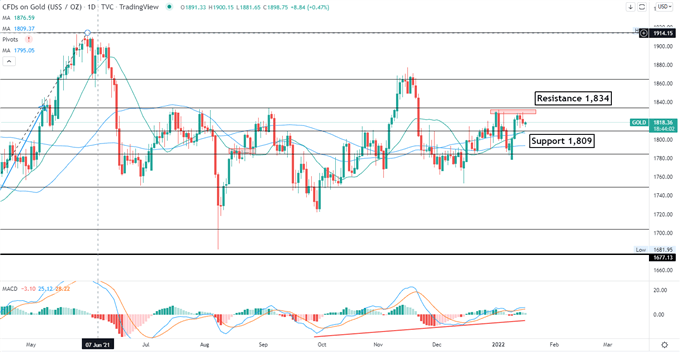

Technically, gold prices remain in a range bound setup, waiting for fresh catalysts. Prices pulled back from an immediate resistance level of 1,834 (38.2% Fibonacci retracement), eyeing 1,809 (50% Fibonacci retracement) for support. Moving average lines are flattening, indicating a lack of clear direction in the near term. The MACD indicator is trending up, suggesting that upward momentum may be building.

Gold – Daily Chart