Euro Forecast: EUR/USD, EUR/JPY, EUR/GBP Short Bets Rise. Will Gains Follow?

EURO, EUR/USD, EUR/JPY, EUR/GBP, TECHNICAL ANALYSIS, RETAIL TRADER POSITIONING – TALKING POINTS

- Retail traders are increasingly betting that the Euro may weaken ahead

- Is this a sign that EUR/USD, EUR/JPY & EUR/GBP may climb instead?

- What are key technical levels to watch for should net-short bets increase?

Euro Forecast :Glancing at IG Client Sentiment (IGCS), retail investors are increasingly betting that the Euro may weaken against the US Dollar, Japanese Yen and British Pound. As a result, net-long exposure in EUR/USD, EUR/JPY and EUR/GBP are on the decline. IGCS can often function as a contrarian indicator. If this trend in positioning continues, the Euro could advance in the coming days.

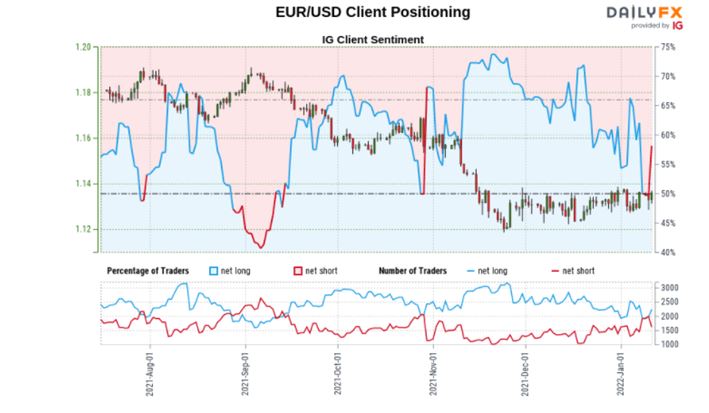

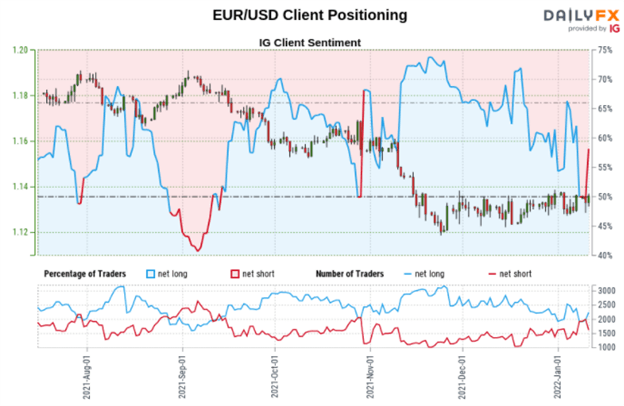

EUR/USD SENTIMENT OUTLOOK – BULLISH

The IGCS gauge shows that about 52% of retail traders are net-long EUR/USD. Since the majority of investors are net-long, this suggests prices may continue falling. However, downside exposure has increased by 19.71% and 40.87% compared to yesterday and last week respectively. The combination of overall and recent changes in positioning hint that prices may reverse higher.

Euro Forecast: TECHNICAL ANALYSIS

EUR/USD continues to consolidate within the boundaries of an Ascending Triangle chart formation. The direction of the breakout could hint at the coming trend. For now, a falling trendline from June is nearing. The latter could reinstate the dominant downtrend since last year. Otherwise, taking out the trendline exposes the 1.1525 inflection point. Closing under triangle support exposes the 1.1169 – 1.1195 range.

Glancing at IG Client Sentiment (IGCS), retail investors are increasingly betting that the Euro may weaken against the US Dollar, Japanese Yen and British Pound. As a result, net-long exposure in EUR/USD, EUR/JPY and EUR/GBP are on the decline. IGCS can often function as a contrarian indicator. If this trend in positioning continues, the Euro could advance in the coming days.

EUR/USD SENTIMENT OUTLOOK – BULLISH

Euro Forecast:The IGCS gauge shows that about 52% of retail traders are net-long EUR/USD. Since the majority of investors are net-long, this suggests prices may continue falling. However, downside exposure has increased by 19.71% and 40.87% compared to yesterday and last week respectively. The combination of overall and recent changes in positioning hint that prices may reverse higher.

TECHNICAL ANALYSIS

EUR/USD continues to consolidate within the boundaries of an Ascending Triangle chart formation. The direction of the breakout could hint at the coming trend. For now, a falling trendline from June is nearing. The latter could reinstate the dominant downtrend since last year. Otherwise, taking out the trendline exposes the 1.1525 inflection point. Closing under triangle support exposes the 1.1169 – 1.1195 range.

Euro Forecast: EUR/USD DAILY CHART

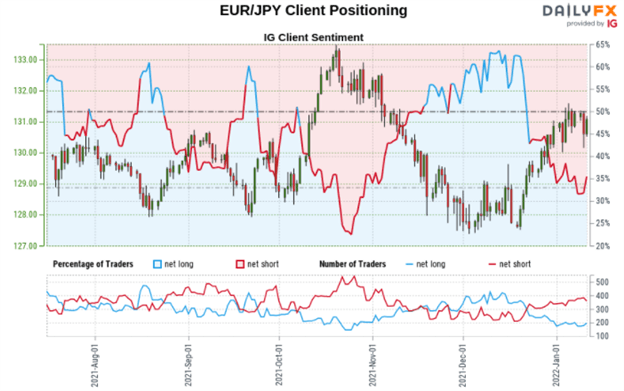

EUR/JPY SENTIMENT OUTLOOK – BULLISH

The IGCS gauge shows that roughly 30% of retail traders are net-long EUR/JPY. Since the majority of investors are net-short, this suggests prices may continue rising. This is as downside exposure increased by 23.28% and 22.22% compared to yesterday and last week respectively. With that in mind, the combination of overall and recent changes in positioning offers a bullish-contrarian trading bias.

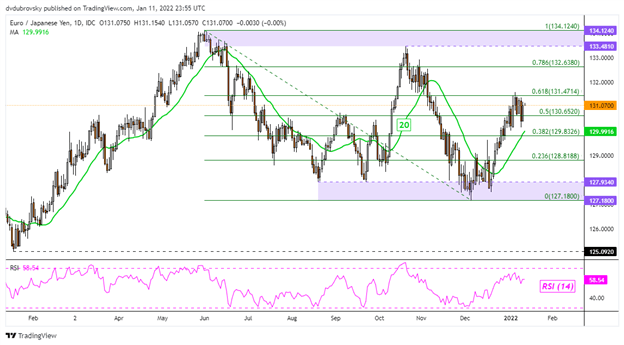

TECHNICAL ANALYSIS

Despite recent consolidation, EUR/JPY remains in a near-term uptrend since December. Zooming further out, the pair has been ranging since May 2021. Clearing immediate resistance, which appears to be the 61.8% Fibonacci retracement at 131.471, exposes the 78.6% level at 132.638. Turning lower places the focus on the 20-day Simple Moving Average, which may reinstate the uptrend.

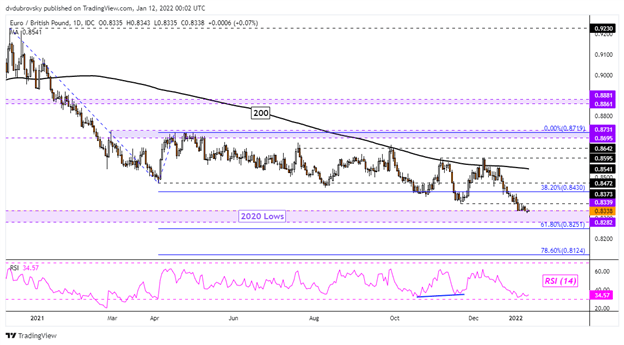

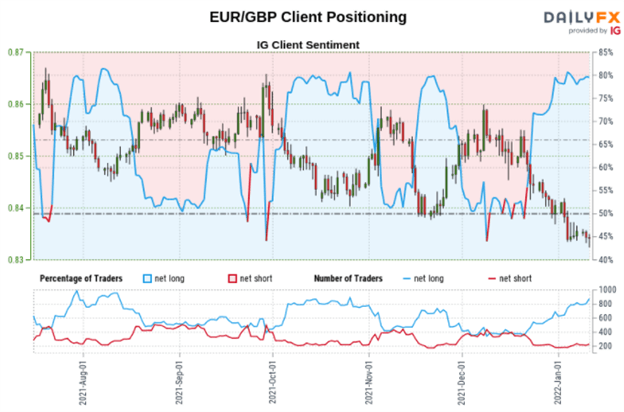

EUR/GBP SENTIMENT OUTLOOK – BULLISH

The IGCS gauge shows that about 76% of retail traders are net-long EUR/GBP. Since the majority of investors are still biased to the upside, this could hint at further losses. However, downside exposure has increased by 20.27% and 40.53% compared to yesterday and last week respectively. With that in mind, the combination of overall and recent changes in positioning hint EUR/GBP may climb from here.

TECHNICAL ANALYSIS

Following persistent losses since September 2020, EUR/GBP has now finally declined to the upper boundary of the 0.8282 – 0.8339 support zone. This range is made up of lows achieved in 2020. As such, the pair may bounce off this zone, placing the focus on the 38.2% Fibonacci extension at 0.8430. On the other hand, clearing the support zone exposes the 61.8% extension at 0.8251.

EUR/GBP DAILY CHART