Gold Price Forecast: XAU/USD eyes critical upside target at $1,835 – Confluence Detector

- Gold price pulls back from multi-week highs amid Fed rate hikes speculation.

- Risk-on sentiment at the start of 2022 also bodes ill for the bright metal.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal.

XAU/USD eyes critical: Gold is feeling the pull of gravity on the first trading day of 2022, in what seems to be a correction from six-week highs of $1,832. Expectations that the upcoming US first-tier economic events, including the ISM PMIs and Nonfarm payrolls, will confirm a March Fed rate hike are keeping the bulls on the back foot. Additionally, the upbeat market mood is collaborating with the pullback in the gold price.

Gold Price: Key levels to watch

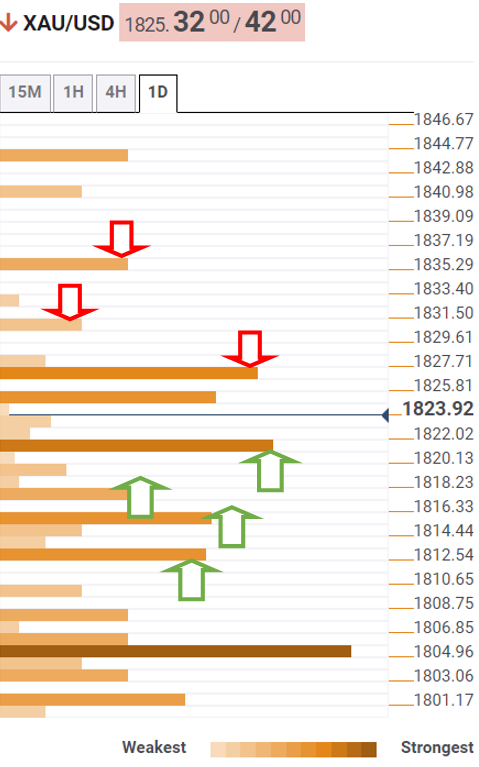

The Technical Confluences Detector shows that the gold price is trading below strong resistance of $1,827; where the Fibonacci 23.6% one-day coincides with the previous high four-hour and SMA10 one-hour.

The next topside hurdle is seen at the previous day’s high of $1,830; above which the multi-week top of $1,832 will be challenged once again.

The pivot point one-day R1 at $1,835 will be a tough nut to crack for gold bulls.

On the flip side, strong support is pegged at $1,821; the intersection of the Fibonacci 61.8% one-day, Fibonacci 23.6% one-week, and previous low four-hour.

The next relevant cap is seen at 1,818, which is the pivot point one-day S1. Friday’s low of $1,815 will be next on sellers’ radars.

The convergence of the SMA100 one-hour and Fibonacci 23.6% one month at $1,812 will be the line in the sand for gold buyers.

XAU/USD eyes critical: Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators; moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies. Hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest; where to unwind positions, or where to increase your position size.