Selling the Retrace Up in EUR/USD at the 20 SMA

Selling the Retrace, EUR/USD turned bearish at the beginning of the summer, but the trend was slow. Now, the trend has accelerated and this pair is breaking all levels one after another. We have opened some short-term and long-term signals in this pair recently, which have closed in profit as the decline picks up pace.

Although, in the last few sessions we have seen a retrace higher, which I think is a good opportunity to sell this pair, so we opened a EUR/USD and a EUR/GBP sell signal just a while ago. The US data continues to come in strong and the jump in the Philly FED manufacturing index today showed just that. It also seems like buyers are getting exhausted, so we’re short on the Euro.

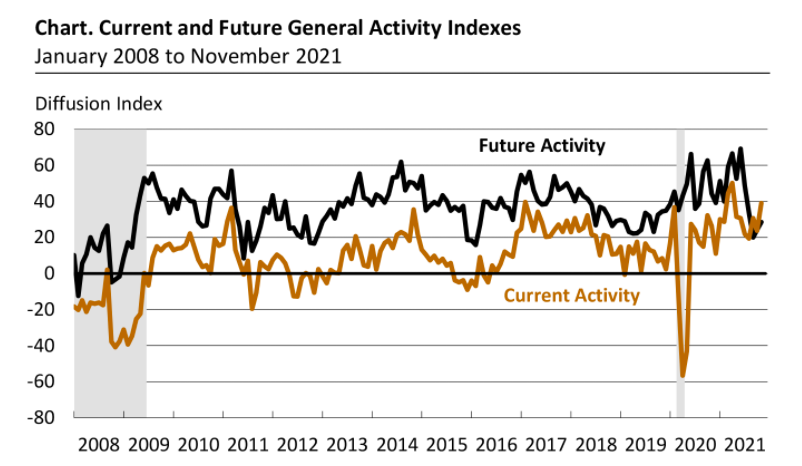

- Selling the Retrace, November Philadelphia Fed manufacturing index 39 points versus 24 estimated

- October was 23.8 points

- Manufacturing index 39 points highest since April

- New orders 47.4 points versus 30.8 last month.

- Employment 27.2 points versus 30.7 last month.

- Average workweek 30.6 points versus 27 points last month.

- Prices paid 80 points versus 70.3 last month.

- Prices received 62.9 points versus 51.1 last month

- Unfilled orders 27.4 points versus 12.7 last month

- Delivery times 35.7 points versus 32.2 last month

- Inventories 13.5 points versus 18.8 last month

Future activity (six months forward) 28.5 verse 24.2 last month.

- New orders 28 points versus 26.2 last month

- Employment 49.3 points versus 37.5 last month

- Average workweek 9.7 points versus 27.2 last month

- Prices paid 63.9 points versus 64.1 last month

- Prices received 59.4 points versus 58 points last month

- Unfilled orders -0.8 points versus -18.1 last month

- Delivery times -1.6 points versus -1.7 last month

- Inventories 14.1 points versus 23.6 last month

For the full report click here

A strong report from the regional Federal Reserve district

Special questions forecast for next year for your firm:

- prices your firm will receive for its own goods and services sold. 5.3 versus 5.0 from August 21

- compensation your firm will pay per employee for wages and benefits. 4.8 versus 4.0 in August 2021

Special questions for consumers:

- prices US consumers will pay for goods and services over the next year 5.0 versus 5.0 in August

- prices US consumers will pay for goods and services over the next 10 years 3.5 versus 3.0 in August

From the Philadelphia Fed:

Responses to the November Manufacturing Business Outlook Survey suggest continued expansion for the region’s manufacturing sector. The indicators for current activity, shipments, and new orders all increased from last month. Additionally, the firms indicated overall increases in employment and more widespread increases in prices paid and received. The survey’s future indexes continue to suggest expected growth over the nextsix months

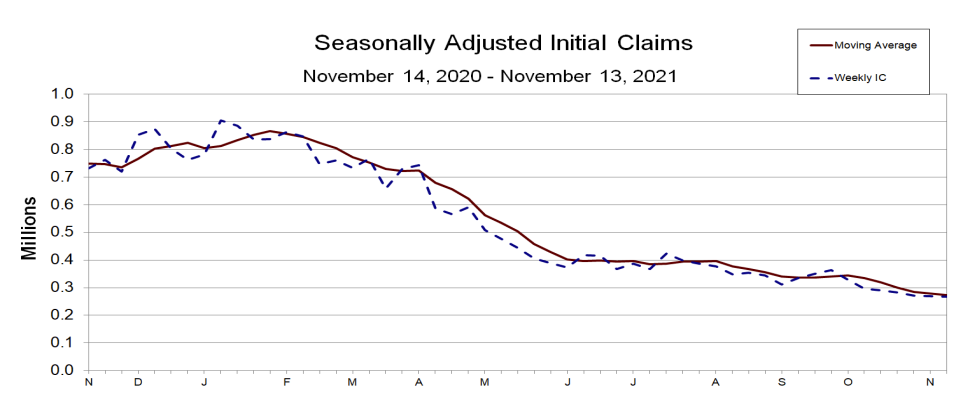

US Initial and Continuing Jobless claims

- Selling the Retrace, Initial jobless claims 268K vs 260K estimate. Prior week revised to 269. This is the lowest level since March 14, 2021 it was 256K

- 4 week moving average 272.75K versus 278.5K. This is the lowest since March 14, 2020 when it was at 225.5K

- Continuing claims 2.08M vs 2.120M estimate

- 4 week moving average of continuing claims 2.157K vs 2.257K last week. This is the lowest level since March 21, 2020

- The largest increases in initial claims for the week ending November 6 were in Kentucky (+6,716), Ohio (+3,846), Tennessee (+2,411), Illinois (+1,893), and Michigan (+1,564),

- The largest decreases were in California (-4,222), District of Columbia (-1,794), and Louisiana (-1,028).