Gold (XAU/USD) Buffeted by Fed Rate Hike Risk and Russia/Ukraine War Fears

GOLD PRICE (XAU/USD), CHART, AND ANALYSIS

- Wednesday’s FOMC monetary policy decision remains key.

- Gold getting a risk-off bid as Russia ramps up invasion fears.

Gold Risk War Fears: Tomorrow’s FOMC rate decision and chair Powell’s subsequent press conference will hopefully give the markets a clear idea of the number and speed of interest rate hikes in the US this year, and next, and how the central bank will start to reduce its bloated balance sheet. Increasingly hawkish market expectations are starting to be reined back and tomorrow’s press conference will hopefully give markets more detail and temper the current volatile market conditions.

S&P Forecast: Rare Reversal Price Action in US Markets, Traders Switch to Sell the Rip

While interest rates will weigh on the price of the precious metal, increased fears that Russia will invade Ukraine is giving gold a flight-to-safety bid, along with the Japanese Yen, Swiss Franc, and longer-dated US Treasuries. Russia has massed around 100,000 troops near Ukraine’s border, sparking calls for ‘an unprecedented package of sanctions’ against the aggressor. This two-way struggle will keep traders on their toes and increase volatility in the precious metal over the weeks ahead.

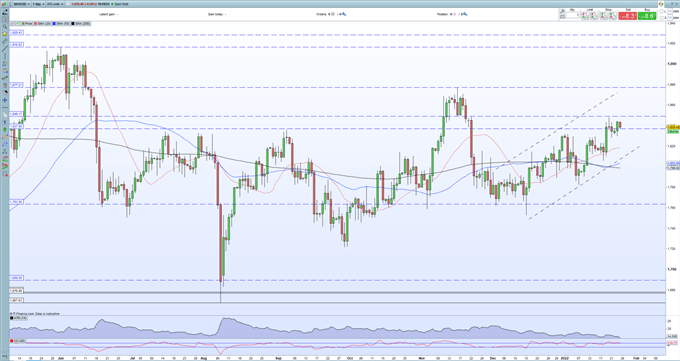

The daily gold chart shows a recent series of higher highs and higher lows being made in the last six weeks as the precious metal moves slowly higher in a basic uptrend channel. All three simple moving averages are now back in a positive lineup, while longer-term horizontal resistance around $1,837/oz. is currently being tested. Above here, resistance lies at $1,849 and the multi-month high at $1,877/oz.

GOLD (XAU/USD) DAILY PRICE JANUARY 25, 2022

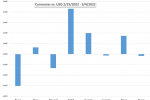

Gold Risk War Fears: Retail trader data show 69.31% of traders are net-long with the ratio of traders long to short at 2.26 to 1. The number of traders net-long is 1.57% lower than yesterday and 1.26% lower from last week, while the number of traders net-short is 9.35% higher than yesterday and 1.48% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece.