GBP/USD Technical Outlook: Forming an Interim Base?

GBP/USD, BRITISH POUND – TECHNICAL OUTLOOK:

- GBP/USD is holding above major support.

- Speculative positioning and traders’ sentiment is less bearish.

- What is the outlook and what are the key levels to watch?

GBP/USD MEDIUM-TERM TECHNICAL FORECAST – NEUTRAL

GBP/USD Forming an Interim Base?: After a drop to a record low last month, the odds of GBP/USD forming an interim base are growing, pointing to an extended pause in coming weeks.

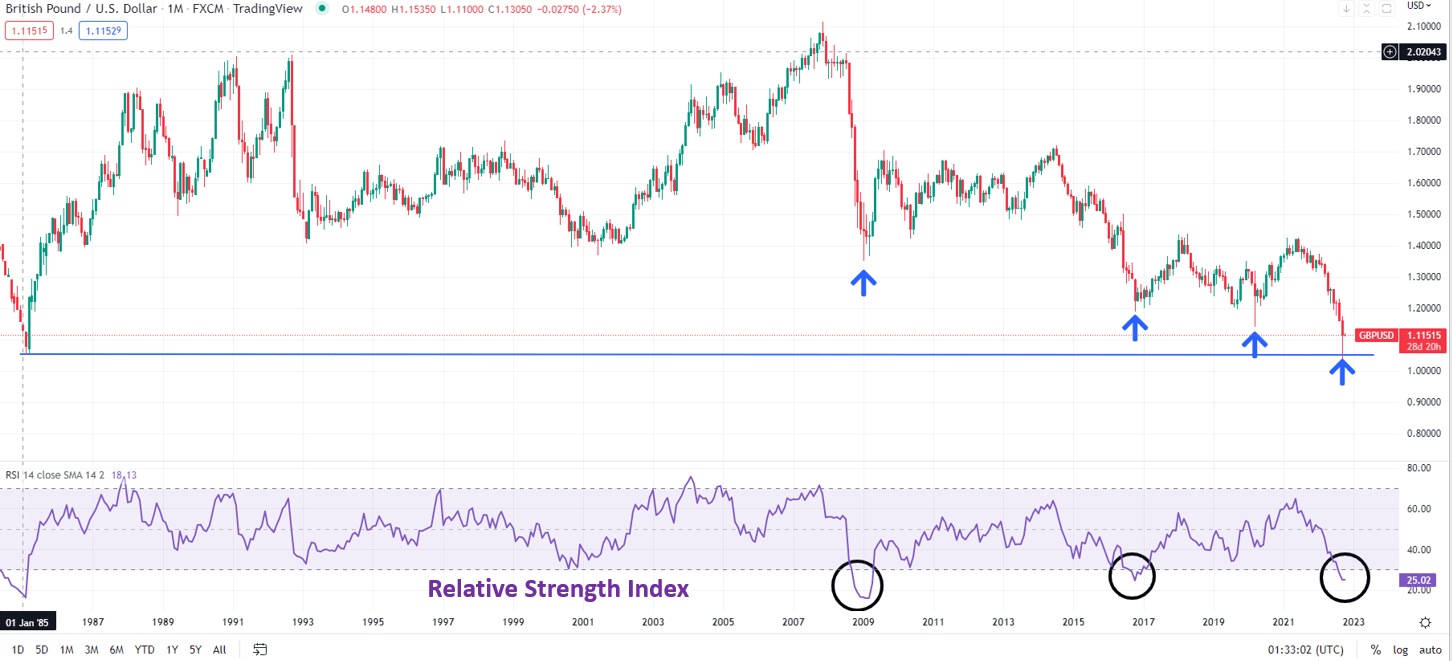

On monthly charts, GBP/USD briefly dropped the 1985 low of 1.0520 before rebounding the Bank of England stepped into calm markets by buying long-dated government bonds. The long-legged candle created on the quarterly and monthly candlestick charts in September at the major support is a reflection of rejection at lower levels – similar to selloffs in 2009 (the Great Financial Crisis), 2016 (Brexit), 2020 (Covid-19). While those reversal candles didn’t spell an end to GBP’s long-term woes, it was enough to trigger a meaningful rebound/an interim pause in the downtrend (see chart).

On the weekly candlestick charts, a piercing line candlestick pattern (a two-day candle pattern that implies a potential reversal from a downtrend) associated with positive momentum divergence (declining price associated with a stall in momentum) is a sign that the downtrend since June 2021 is losing steam.

GBP/USD Monthly Chart

GBP/USD Forming an Interim Base?

From a sentiment perspective, participants seem to be turning less bearish on the pound despite the plunge last week. The CFTC speculative positioning, while remaining short, reduced last week, and cut by a third since May – a sign that shorts are getting exhausted. The IG Client Sentiment (IGCS) index shows a higher percentage of traders prefer going long GBP from a weekly perspective (54% of traders). Moreover, from a valuation perspective, the pound seems to be heavily discounted relative to fundamentals – more than 20% discount to its Purchasing Power Parity (PPP), according to market estimates.GBP/USDMIXEDData provided by of clients are net long.

GBP/USD SHORT-TERM TECHNICAL FORECAST – SLIGHTLY BEARISH

Having said that, the road to an eventual stability could be bumpy. After staging the best week in 2 ½ years, the momentum on hourly charts seems to be stalling. A minor setback in coming days towards quite strong support area of 1.0920-1.1020 wouldn’t be surprising (see chart). Stronger support is at the September 29 low of 1.0800, roughly coinciding with the lower edge of a rising channel from September. Even if GBP/USD were to experience a significant leg lower, it would be tough to crack the September 28 low of 1.0535.

On the upside, there is initial resistance at the March 2020 low of 1.1400, followed by resistance on the 10-week moving average (the last time it closed above this average on a weekly basis was in February). For the medium-term downward pressure to fade, GBP/USD needs to rise above the 200-day moving average (now at about 1.2575).

GBP/USD Hourly Chart