Gold Price Eyes November High After Clearing Monthly Opening Range

Gold Price Eyes November: The price of gold trades to a fresh monthly high ($1854) ahead of the Federal Reserve interest rate decision amid the deterioration in risk appetite, and bullion appears to be on track to test the November high ($1877) after clearing the opening range for January.

GOLD PRICE EYES NOVEMBER HIGH AFTER CLEARING MONTHLY OPENING RANGE

The price of gold appears to be benefitting from the recent rout in global equity prices as it continues to trade to fresh monthly highs, and it remains to be seen if the Federal Open Market Committee (FOMC) rate decision will derail the recent rise in gold prices as the central bank prepares to normalize monetary policy.

Gold Price Eyes November: The FOMC is expected to keep the benchmark interest rate at the record low as the central bank tapers its asset purchases, and the committee may attempt to buy time ahead of the next quarterly meeting in March as the “rise in COVID cases in recent weeks, along with the emergence of the Omicron variant, pose[s] risks to the outlook.”

As a result, the FOMC may retain the current forward guidance for monetary policy as “participants expect a gradual pace of policy firming,” and more of the same from Chairman Jerome Powell and Co. may keep the price of gold afloat as market participants push out bets for quantitative tightening (QT).

However, the FOMC may unveil a more detailed exit strategy as the central bank “decided to double the pace of reductions in its asset purchases” at its last meeting for 2021, and talks of unloading the Fed’s balance sheet may drag on the price of gold as market participants prepare for a change in regime.

With that said, the price of gold may attempt to test the November high ($1877) as it continues to trade to fresh monthly highs, but the Fed rate decision may rattle the recent advance in bullion if the central bank shows a greater willingness to normalize monetary policy sooner rather than later.

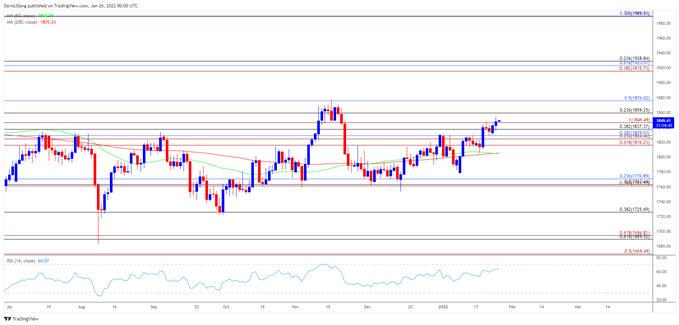

DAILY CHART

- The broader outlook for the price of gold has become relative flat as the 50-Day SMA ($1805) and 200-Day SMA ($1805) continue to converge with one another, and the precious metal may trade within a defined range as it tracks the price action from the fourth quarter of 2021.

- The price of gold appears to be on track to test the November high ($1877) after clearing the opening range for January, but need a break/close above the $1859 (23.6% retracement) region to bring the $1876 (50% retracement) area on the radar.

- A break above the November high ($1877) opens up the Fibonacci overlap around $1916 (38.2% expansion) to $1929 (23.6% retracement), with the next area of interest coming in around $1989 (78.6% retracement).

- However, failure to test the break/close above the $1859 (23.6% retracement) region may push the price of gold back towards the $1837 (38.2% retracement) to $1847 (100% expansion) area, with a move below the Fibonacci overlap around $1816 (61.8% expansion) to $1829 (38.2% expansion) bringing the monthly low ($1779) on the radar.