Preparing to Buy USD/CAD After the Canadian GDP, As Powell Wants to Speed Up Tapering

Preparing to Buy USD/CAD has been on a bullish trend since the beginning of summer, when it reversed above 1.20, after being on a strong bearish trend for more than a year. In October we saw a pullback, as the USD retreated, but in November this pair resumed the bullish trend again, as the USD turned bullish again.

The FED accepted surging inflation and they decided to start tapering, which puts the US dollar on a long-term uptrend. Today, the Canadian GDP report for Q3 showed great improvement, but we still remain bullish for this pair, especially after Jerome Powell wants to speed up tapering. Below is the Canadian GDP report and comments from Powell:

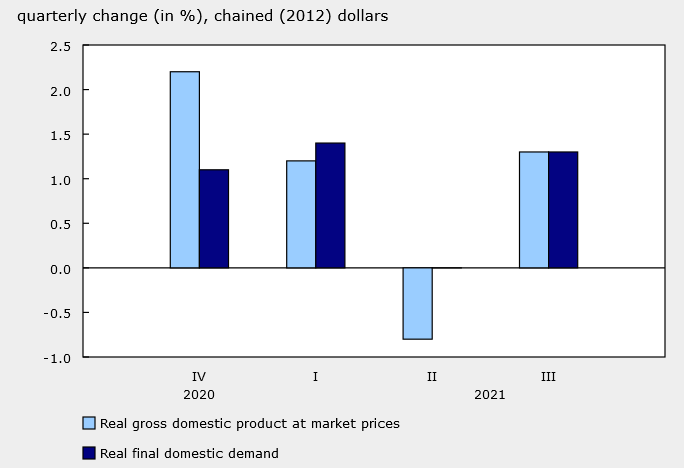

Canadian GDP data for the third

- Q3 GDP +5.4% vs +2.5% expected

- Q2 GDP was -1.1%

- Q/Q GDP +1.3% vs -0.3% prior (revised to -0.8%)

- October GDP +0.8% vs +0.1% expected

- September GDP was up 0.4%

- Full report

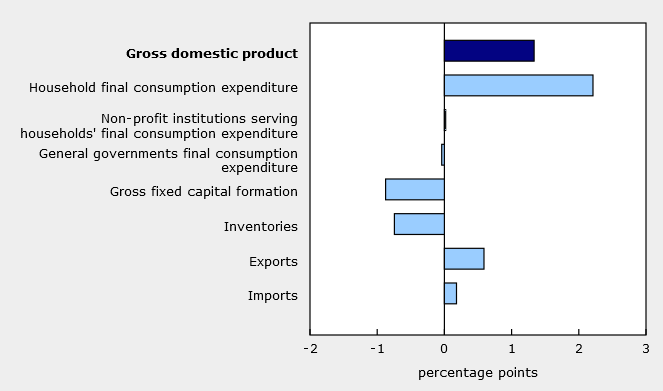

Consumer spending roared in the quarter while inventories trimmed 0.74 pp from GDP. I suspect that will be unwinding in the quarters ahead as companies re-stock following the drawdown due to supply chain problems. Fixed investment was dogged by a 5.2% drop in new construction, which is also a supply chain story.

Here’s an ominous sign:

Remarkable accumulation of residential mortgage liabilities in the previous quarter continued, with households adding $38 billion in the third quarter, more than double that of two years earlier.

A good sign though is that the household savings rate remains extremely elevated, at 11.0% compared to 14.0% in Q2. It’s the sixth consecutive quarter with a double-digit savings rate.

Preparing to Buy USD/CAD, Powell Puts A Faster Taper Squarely on the Table

- It’s a good time to retire “transitory” for inflation

- Very surprising that labor force participation has moved sideways

- A big part of flat labor force participation rate is the pandemic

- It will take longer to get labor force participation back

- Risk of higher inflation is a risk to getting back to full employment

More comments:

- Markets are baking in a return to lower inflation in the longer term

- It’s appropriate to talk about speeding up taper at coming meeting

- For now, omicron is a risk, not baked into forecasts

- We’ll know more in 5-10 days and much more in a month

- Not thinking the effects of omicron will be remotely comparable to March 2020

- We will see covid-19 effects over time diminished

Preparing to Buy USD/CAD, Powell’s earlier comment about ‘transitory’ being retired started the turnaround and this latest comment confirmed it. He said it’s appropriate at the December meeting to discuss whether to wrap up bond purchases a few months earlier.

Powell isn’t shying away on omicron fears and is instead signaling that the taper could be spent up at the Dec 15 meeting. At the same time, he said we will know more about omicron in the next week or 10 days. Of course, the Fed blackout starts on Saturday so the market will be in suspense.

For now though, the US dollar is ripping higher and equities are falling as Powell catches the market off guard with hawkish rhetoric. The pound is getting the worst of this as it craters to a fresh low for the year.