-

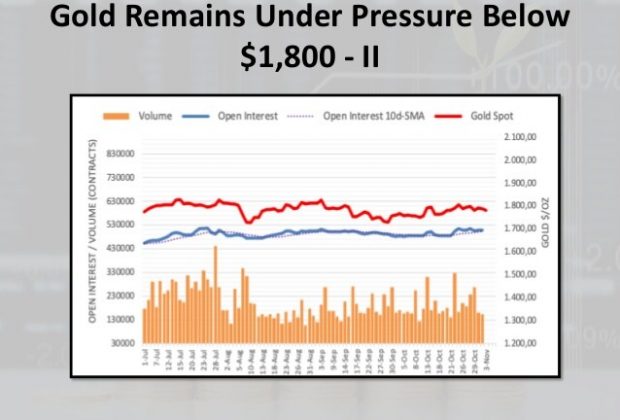

Gold pares intraday; Gold justifies options market’s bearish bias below $1,800

Gold pares intraday losses around $1,775 amid risk reset. In addition to the market’s rush for traditional safe-havens like the ... -

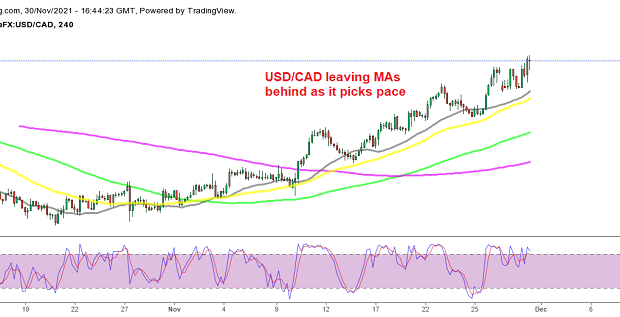

Preparing to Buy USD/CAD After the Canadian GDP, As Powell Wants to Speed Up Tapering

Preparing to Buy USD/CAD has been on a bullish trend since the beginning of summer, when it reversed above 1.20, after ... -

China’s Manufacturing Activity Back in Expansion in November

China’s Manufacturing; Manufacturing activity across China improved during the month of November as the leading economy saw a decline in ... -

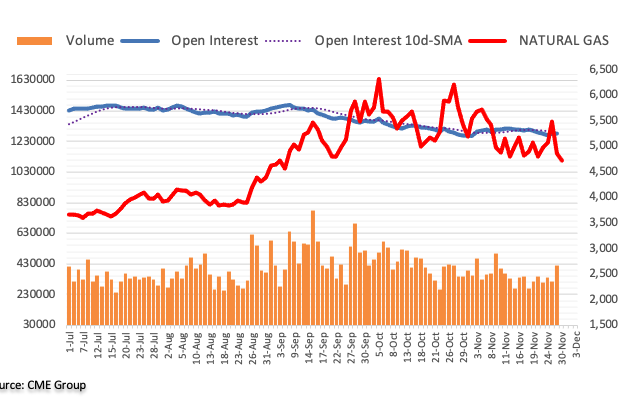

Natural Gas Futures: Further consolidation on the table

Natural Gas Futures: According to flash data from CME Group for natural gas futures markets; open interest resumed the downtrend ... -

Gold Revisits $1,781 Support – A Good Buy Opportunity

Gold Revisits, [[Gold ]] prices closed at $1,788.45, after placing a high of $1,801.50 and a low of $1,783.35. Gold reversed ... -

China’s Manufacturing Activity Back in Expansion in November

China’s Manufacturing activity across China improved during the month; of November as the leading economy saw a decline in both ... -

CRUDE OIL, US DOLLAR, OPEC+,OMICRON, WHO, WTI – TALKING POINTS

CRUDE OIL fell over 13% on Friday after the World Health Organisation (WHO) verified a new strain of Covid-19 that has ... -

EUR/USD now seen within a consolidative mode – UOB

EUR/USD, Key Quotes ccording to FX Strategists at UOB Group, EUR/USD has now moved into a consolidative phase , 24-hour view: “We ... -

Gold Regains Strength: Why $1,803 is The Key For More Upsides

Gold Regains, Happy Friday, traders. Gold is trading with a slight bullish bias at 1,797 level heading towards the 1,802 mark. Yesterday, XAU/USD closed ... -

Forex Today: Market sentiment remains fragile as investors eye ‘Omicron’ headlines

Forex Today: The intense flight to safety on Friday triggered a sharp decline in US Treasury bond yields and caused ...