Gold Breaks Below 1,791 Level Pivot Point – Brace For a Sell Trade

Gold Breaks, GOLD prices were closed at $1793.50 after reaching a high of $1804.40 and a low of $1783.10. Gold extended, its loss for the fourth consecutive session on the back of strength in the U.S. dollar. The U.S. Dollar Index, which measures the greenback’s value against a basket of six major currencies, surged for a second consecutive session on Wednesday and reached the 92.86 level. On the other hand, 10-year Treasury yields in the United States remained lower on Wednesday, at 1.32%.

On the data front, at 19:00 GMT, JOLTS Job Openings in July surged to 10.93M against the estimated 10.03M and supported the U.S. dollar that dragged gold prices further to the downside. At 19:02 GMT, the IBD/TIPP Economic Optimism for September fell to 48.5 from the forecast 55.3, weighing on the U.S. dollar and causing gold prices to fall further.

On Wednesday, the President of the New York Federal Reserve Bank, Jon C. Williams, offered a hint that it might be possible for the central bank to start tapering support for the economy ahead of the end of the year, even if the job market begins at an uninspiring pace in the coming month.

He further said that he had been looking at the cumulative level of employment progress rather than monthly changes, and he suggested that weakening job growth would not necessarily make impossible a start to the so-called tapering. He also confirmed that pulling back on bond-buying will be a first step in removing support, and the Fed’s policy interest rate will remain at near-zero for some time.

Gold Breaks

The U.S. dollar gathered extra strength from the comments of Fed President Williams as he provided some hints about tapering. Investors cheered the remarks of Williams as they were long awaiting any hints on tapering, and hence, the greenback moved higher, pushing gold to the downside.

Meanwhile, yellow metal losses were limited due to concerns about a global slowdown; which weighed on the market’s risk sentiment. The rising coronavirus cases in the U.S. weighed on the U.S. job growth recovery last month, triggering speculation that the Fed could delay tapering. These concerns kept supporting gold prices and capitulating to further losses.

Furthermore, the market’s attention has been drawn to the upcoming European Central Bank meeting, where policymakers are expected to decide on tapering PEPP purchases. This also kept gold prices under pressure for the day.

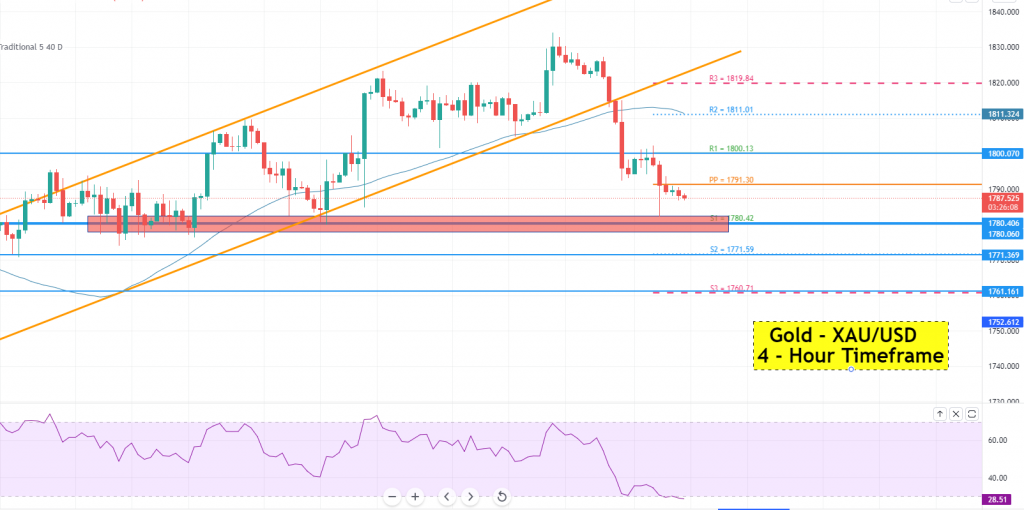

Gold (XAU/USD) Technical Outlook – Pivot Point Resistance at 1,791 Level

Gold is currently trading with a bearish bias; as it remains below a pivot point trading level of 1,791. On the other hand, near 1780; gold is projected to find immediate support. The breakout at the 1,780 level is expected to extend a selling trend till the next support level of 1771. Below that, the next support level of 1,760 will prevail.

Daily Technical Levels

Support Resistance

1782.94 1804.24

1772.37 1814.97

1761.64 1825.54

Pivot Point: 1793.67

The breakout at the 1,780 level is expected to extend a selling trend till the next support level of 1771. Below that, the next support level of 1,760 will prevail. The 1,791 level, which is stretched by the intraday pivot point level; is likely to act as immediate resistance for the pair. GOLD prices will be open to the 1,800 level if a positive breakout occurs, with the next resistance level being around the 1,811 level.

Gold prices will be open to the 1,800 level if a positive breakout occurs, with the next resistance level being around the 1,811 level. The 50-period exponential moving average in the 4-hour time frame is anticipated to prolong resistance around the 1,811 level.

The closing of candles underneath this level indicates that the precious commodity; gold, is being sold.Take a look at the RSI, the most popular technical indicator. It means that the precious metal gold has a significant selling tendency today. On Thursday; look for opportunities to sell shares below 1,791 with a target of 1,780. Good luck!