British Pound Down Even as Hot CPI Data Beckons BOE Rate Hikes

UK CPI, INFLATION, BANK OF ENGLAND, BRITISH POUND – TALKING POINTS:

- British Pound down despite hotter-than-expected inflation data

- Spotlight turns to fiscal policy as Sunak readies Sprint Statement

- GBP/USD has a long way to go to neutralize the downtrend

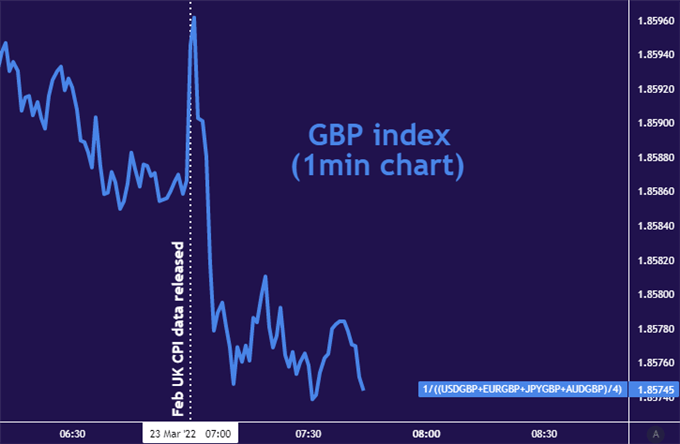

British Pound Down: The spiked briefly higher, then slipped to session lows as hotter-than-

expected UK CPI data

failed to make an impression on Bank of England policy bets. The core rate of inflation rose to 5.2 percent

year-on-year in February, topping baseline expectations of a more modest 5 percent result.

While this marks the fastest pace of price growth in 30 years, the data’s implications seem to be adequately

embedded into the markets’ Bank of England policy expectations. These call for between 5-6 further rate

hikes of 25bps each before the end of the year. That seems to be aggressive enough for traders, at least for

now.

Looking ahead, all eyes are on the Chancellor of the Exchequer Rishi Sunak, who will deliver the government’s

Spring Statement. It is expected to deliver a raft of programs to help households cope as inflation drives up

cost-of-living expenses. Energy costs may be a particular focus.

This makes for a tricky policy mix. Embracing an expansionary fiscal stance runs the risk of fanning the flames

of price growth, compounding the issue further and demanding still-swifter action from the BOE. To that end,

traders will be keen to weigh up the ambition of Mr Sunak’s proposals.

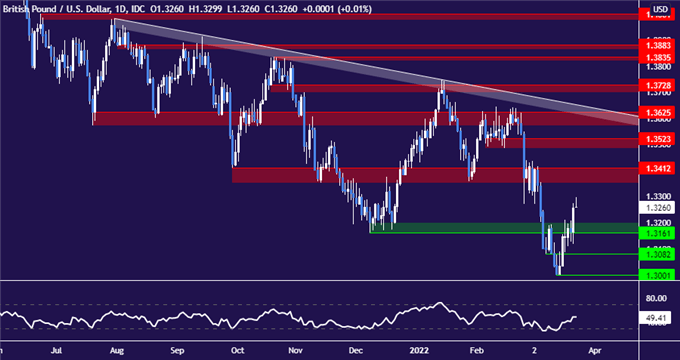

GBP/USD TECHNICAL ANALYSIS

Prices have staged a recovery following a test of the 1.30 figure. The bulls now face a formidable challenge on approach to a dense resistance area capped at 1.3412. Breaking above that may set the stage for a test of 1.3523. Neutralizing the dominant downtrend seems to demand a further push north of the 1.36 mark, however.

On the downside, initial support looks to be anchored at 1.3161. Taking that out sees a minor inflection point at

1.3082 along the way back to challenge the key swing bottom at 1.30.

FX TRADING RESOURCES

Just getting started in the markets? See our free trading guides

What is your trading personality? Take our quiz to find out

Join a free webinar and have your trading questions answered