EUR/USD Reverses on ECB President Lagarde’s Comments and Inflation Report

The EUR/USD has been trying to turn bullish for a couple of weeks, but the ECB’s brushing off of inflation as temporary has been keeping the Euro down. The ECB is still not looking worried about inflation, as they expect it to cool off in 2022, and they are more confident regarding the coronavirus, which they believe has a weaker impact now. So, the EUR/USD bounced higher today, after Lagarde’s comments which are below:

Comments by Lagarde in the opening statement yesterday

- Momentum has moderated but the Eurozone continues to recover strongly

- Expects inflation to rise further, then decline in 2022

- Grip of the pandemic has weakened

- High energy prices may reduce purchasing power

- Economy expected to exceed pre-pandemic level by year end

- Risks to the outlook are balanced (previously, was ‘broadly balanced’)

- Economy could outperform if consumers become more confident

- Recovering demand is outpacing supply

EUR/USD, Lagarde Q&A Session

- Analysis does not support market based lift-off expectations

- Phase of higher inflation to last longer than expected (but still temporary)

- We continue to see inflation below target in the medium term

- We’ve looked in-depth at inflation but we’re confident that our analysis of inflation is correct

- Did soul searching on inflation but concluded it was correct

- PEPP, in my view, will end in March

- It’s not for me to say whether markets are ahead of themselves

- We will be very attentive to wage inflation

- As of now, we have no reason to see second round wage effects

The Euro has jumped, but she’s pushing back on market pricing for rate hikes, which show a 20 bps hike in Dec 2022.

- “Our analysis certainty does not support that the conditions of our forward guidance are satisfied at the time of liftoff as expected by markets, nor any time soon thereafter.”

- “We looked very deeply and tested our analysis of the drivers of inflation and we are confident that our anticipation and our analysis is actually correct.”

That puts the ECB on the other side of some other central banks that are increasingly worried about inflation.

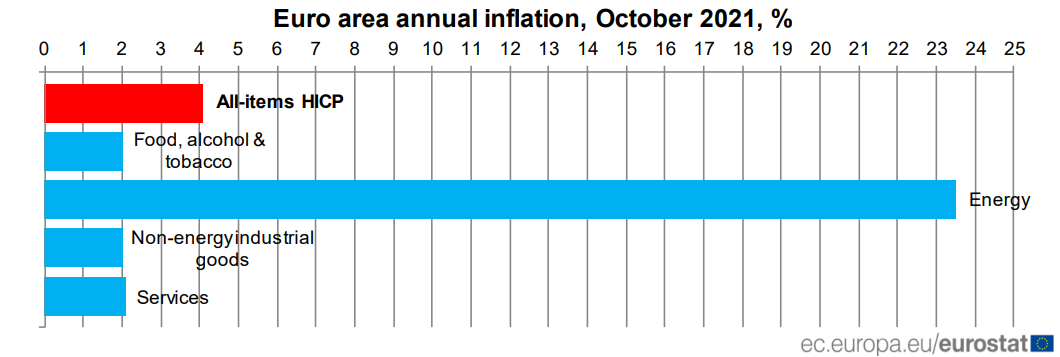

Latest data released by Eurostat – 29 October 2021

- Eurozone October preliminary CPI YoY +4.1% vs +3.7% expected

- September CPI was +3.4%

- Core CPI YoY +2.1% vs +1.9% expected

- September core CPI was +1.9%

*ECB front door* Knock, knock. Inflation is here. The headline reading jumps to a 13-year high and the core reading exceeding 2% just adds to the headache for the ECB, even as Lagarde continued to defend the ‘transitory’ narrative in her press conference yesterday.

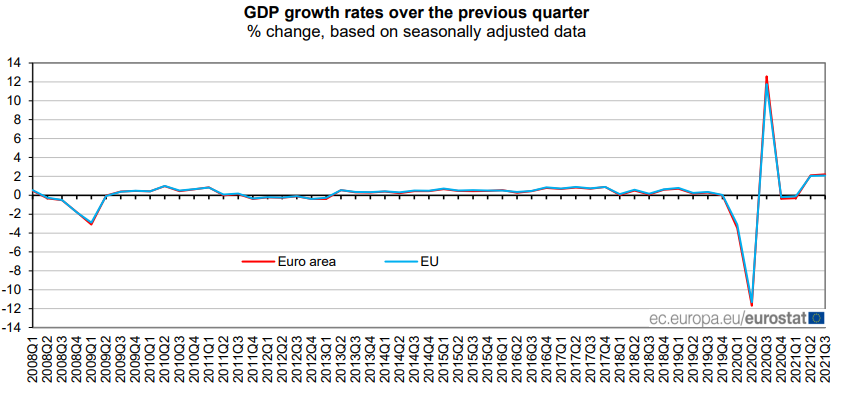

EUR/USD, Latest data released by Eurostat – 29 October 2021

- Eurozone Q3 preliminary GDP +2.2% vs +2.0% expected

- Q2 GDP was +2.2%

- GDP Yoy +3.7%

- Prior GDP YoY was+14.3%

The Eurozone economy grew by a little more than expected, as overall conditions picked up further after the easing of restrictions that began in Q2. The outlook is still a worry though, considering that rising inflation and supply bottlenecks persist.